Video:

Take our online poll:

AI Analysis:

A flat to lowering capital expenditure (capex) in an economy can indicate several things about its health and prospects:

1) Economic Uncertainty: Businesses may reduce or maintain capex in uncertain economic environments. A lack of confidence in future economic conditions can lead to a conservative approach in terms of investment.

2) Slow Economic Growth: A stagnant or decreasing capex may signal slow economic growth. Businesses may hold back on investing in new projects or expanding operations when they anticipate weaker demand or uncertain market conditions.

3) Reduced Job Creation: Capex often involves investments in new facilities, technology, and equipment, contributing to job creation. A decline in capex may result in fewer job opportunities and slower employment growth.

4) Competitiveness Concerns: If businesses are cutting back on capital spending, it could suggest concerns about competitiveness. This might be due to factors such as high production costs, regulatory challenges, or global market dynamics.

5) Impact on Innovation: Reduced capex might limit investments in research and development, potentially hindering innovation. This could have long-term implications for an economy's ability to stay competitive and adapt to changing technological landscapes.

6) Capital Utilization: A lack of new investments may lead to underutilization of existing capacity, which could negatively impact productivity and efficiency.

7) Credit Conditions: The availability and cost of credit can influence capex decisions. If businesses face challenges in accessing affordable financing, it may constrain their ability to invest in growth opportunities.

8) Government Policy Impact: Fiscal and monetary policies can influence capex decisions. Uncertain or unfavorable policy environments may deter businesses from making long-term investments.

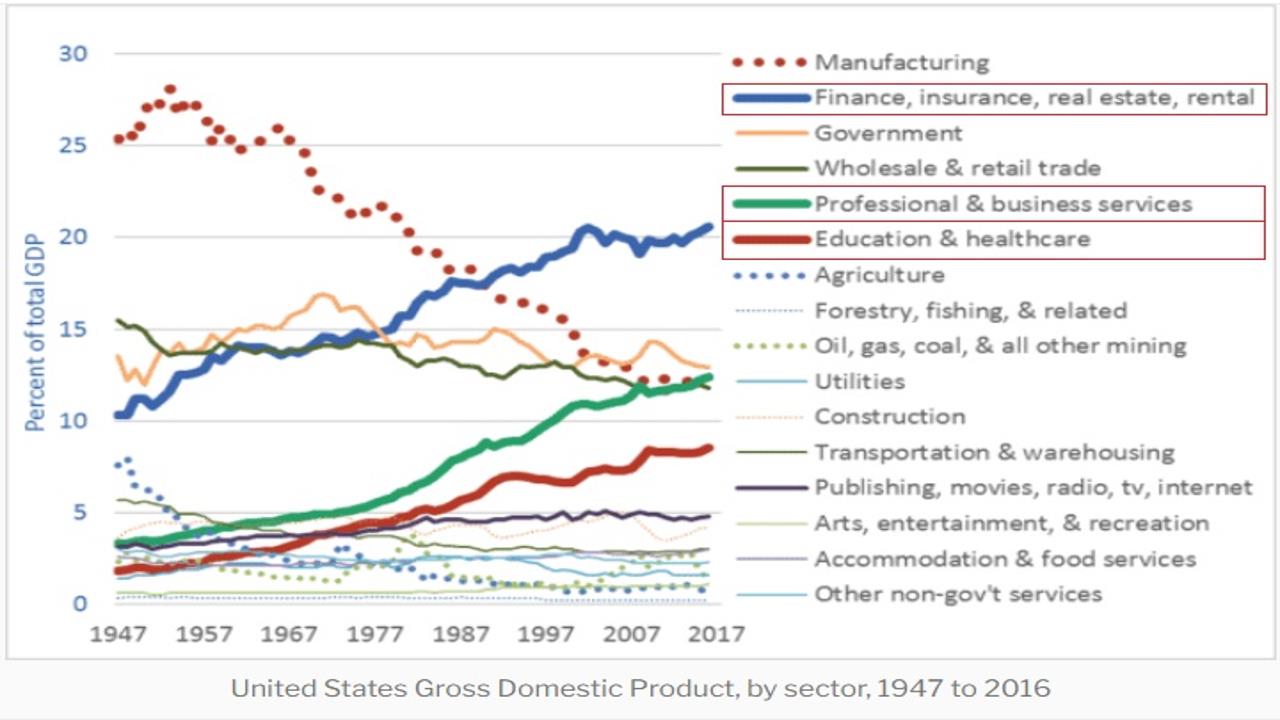

9) Industry-Specific Trends: Capex trends can vary by industry. For example, cyclical industries may experience fluctuations in investment based on economic cycles, while technological advancements might drive capex in certain sectors.

10) Global Economic Factors: Capex decisions may be influenced by global economic conditions and trade dynamics. Businesses operating in international markets may adjust their investment plans based on global economic trends.

It's essential to consider the broader economic context and the reasons behind the trend in capex. While a decline in capex can raise concerns about economic health, it is not necessarily a definitive indicator. External factors, government policies, and industry-specific conditions all contribute to the complex landscape of capital expenditure in an economy.

Chart:

References:

Comments