Video:

Take our online poll:

AI Analysis:

Gold prices can skyrocket due to various factors, including these four reasons:

Economic Uncertainty and Market Volatility: Gold is often viewed as a safe haven asset during times of economic uncertainty, geopolitical tensions, or market volatility. When investors fear economic downturns, inflation, or currency devaluation, they tend to seek refuge in gold, driving up its price.

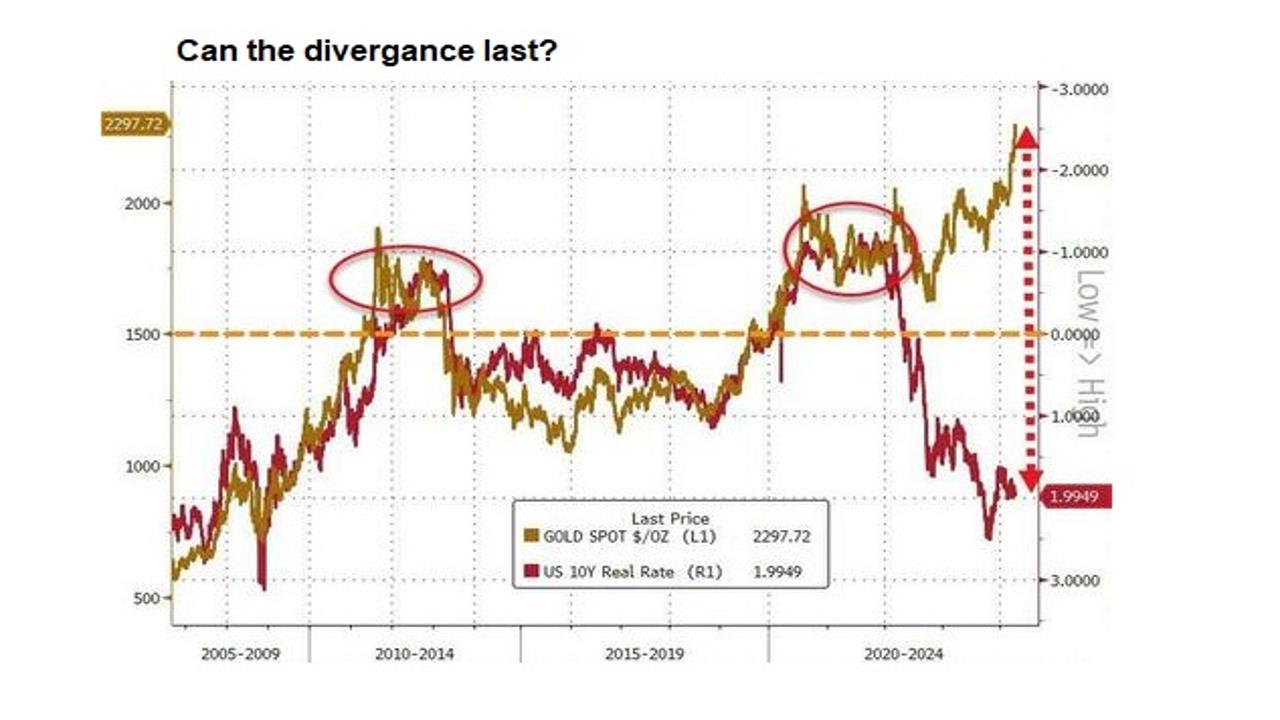

Monetary Policy and Interest Rates: Changes in monetary policy, particularly when central banks embark on aggressive stimulus measures or lower interest rates, can increase demand for gold. Low interest rates reduce the opportunity cost of holding gold, making it more attractive to investors as an alternative store of value.

Inflation Concerns: Gold is often seen as a hedge against inflation. When investors anticipate rising inflationary pressures, they may allocate more capital to gold to preserve purchasing power. This increased demand can lead to a surge in gold prices.

Supply Constraints and Production Costs: Gold supply is limited, and the costs associated with mining and production can influence prices. Factors such as declining ore grades, higher production costs, geopolitical risks in major gold-producing regions, and regulatory hurdles can constrain supply. Any disruptions to gold production or supply chain logistics can lead to a rapid increase in prices.

These factors, either individually or in combination, can trigger a significant surge in gold prices, driving demand for the precious metal and leading to a rapid appreciation in its value.

Chart:

References:

Comments