Video:

Take our online poll:

AI Analysis:

Do the Rich Pay Their Fair Share of Taxes?

The question of whether the rich pay their fair share of taxes is highly debated. Looking at the data from the charts, we can break this down into key areas:

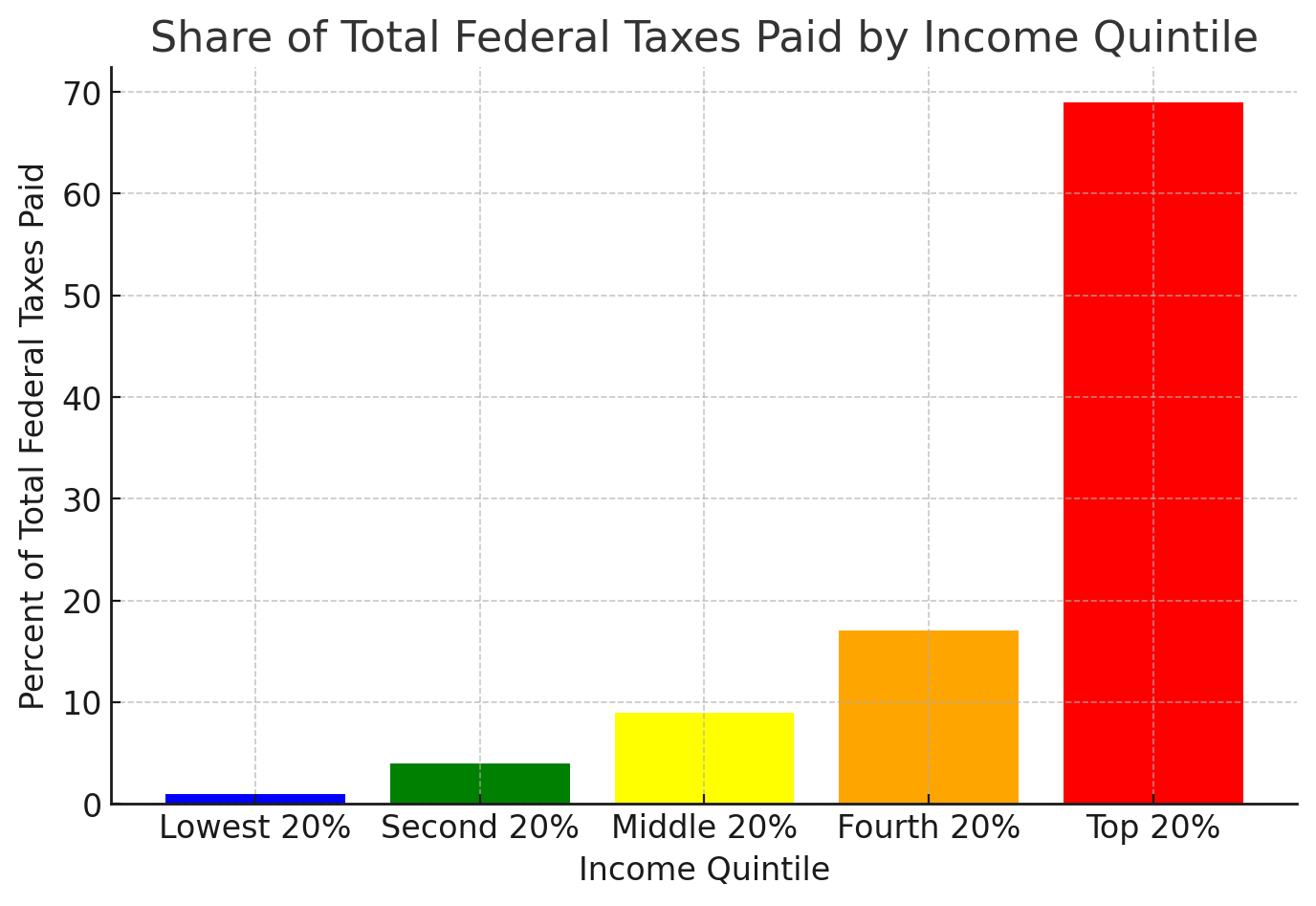

- Share of Total Federal Taxes Paid

The first chart showed that the wealthiest 20% pay 69% of total federal taxes, while the lowest 20% pay only about 1%. At first glance, this suggests that the rich are shouldering the vast majority of the tax burden. However, this figure does not take into account relative tax burden compared to total wealth.

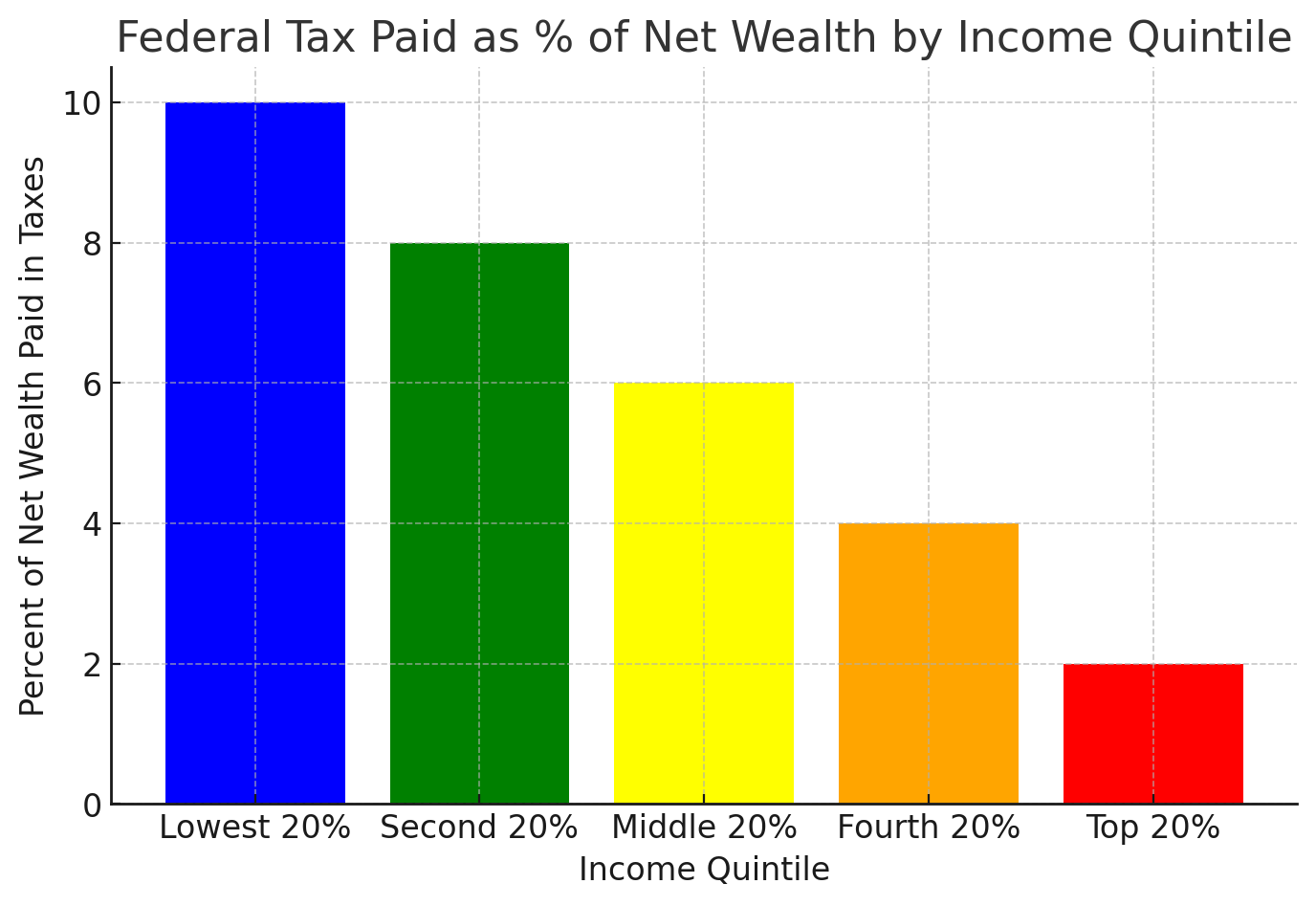

- Taxes Paid Relative to Wealth

The second chart revealed a different perspective—when measuring taxes as a percentage of net wealth, the poorest groups pay a significantly higher share of their wealth in taxes than the rich. The bottom 20% paid around 10% of their wealth, while the top 20% paid only 2%. This suggests that while the rich contribute the most in absolute dollars, their tax burden relative to their immense wealth is much smaller.

- Breakdown of Wealth Growth (Income vs. Other Gains)

The third chart provided insight into how different income groups generate wealth.

Lower-income groups rely primarily on wages and salaries. Higher-income groups see most of their wealth growth from investments, capital gains, and other financial benefits. This is critical because wages are taxed at higher rates than capital gains, dividends, and other passive income, which often enjoy lower tax rates. Additionally, the wealthy have more access to tax-advantaged strategies like trusts, offshore accounts, and deductions, further reducing their effective tax rate.

Is the Tax System Fair?

It depends on how one defines "fair":

If fairness is based on total dollars paid, the rich do pay the most. The wealthiest 20% cover nearly 70% of federal taxes. If fairness is based on tax burden relative to wealth, the rich pay significantly less than the poor. Wealthier individuals often pay a lower percentage of their net worth in taxes compared to lower-income individuals. If fairness is about taxing different types of income equally, the system is skewed in favor of the rich. Capital gains and investment income are taxed at lower rates than wages, benefiting those who make money through investments rather than labor.

Conclusion

While the rich do contribute the most tax revenue in absolute terms, the structure of the tax system allows them to pay a lower percentage of their wealth compared to lower-income groups. The preferential treatment of investment income, coupled with tax strategies that disproportionately benefit the wealthy, results in a system where wealth accumulation is taxed more lightly than wages.

If the goal is a tax system where everyone pays an equal percentage of their total wealth, then the rich are not paying their fair share. However, if the measure of fairness is based on absolute dollars contributed, then they clearly shoulder most of the tax burden.

Chart:

References:

Comments