Video:

Take our online poll:

AI Analysis:

Certainly, here are nine indicators that can provide insight into the health of consumers and their overall economic well-being:

1) Consumer Spending: One of the most direct indicators of consumer health is their spending behavior. Increasing consumer spending often indicates confidence in the economy and suggests that consumers have disposable income to spend on goods and services.

2) Retail Sales: Retail sales data, which includes purchases of various consumer goods, can give an idea of the overall demand for products. Rising retail sales are generally indicative of strong consumer demand.

3) Personal Savings Rate: The personal savings rate measures the percentage of disposable income that consumers are saving rather than spending. A higher savings rate might indicate cautious spending or a need to build a financial buffer, while a lower rate might suggest increased consumer confidence and spending.

4) Consumer Confidence Index: This index measures how optimistic consumers are about the economy's future prospects. High consumer confidence tends to lead to increased spending, while low confidence can result in decreased spending.

5) Household Debt Levels: Monitoring the levels of household debt, including credit card debt, mortgages, and personal loans, can provide insight into consumers' financial stability. High levels of debt relative to income could indicate potential financial strain.

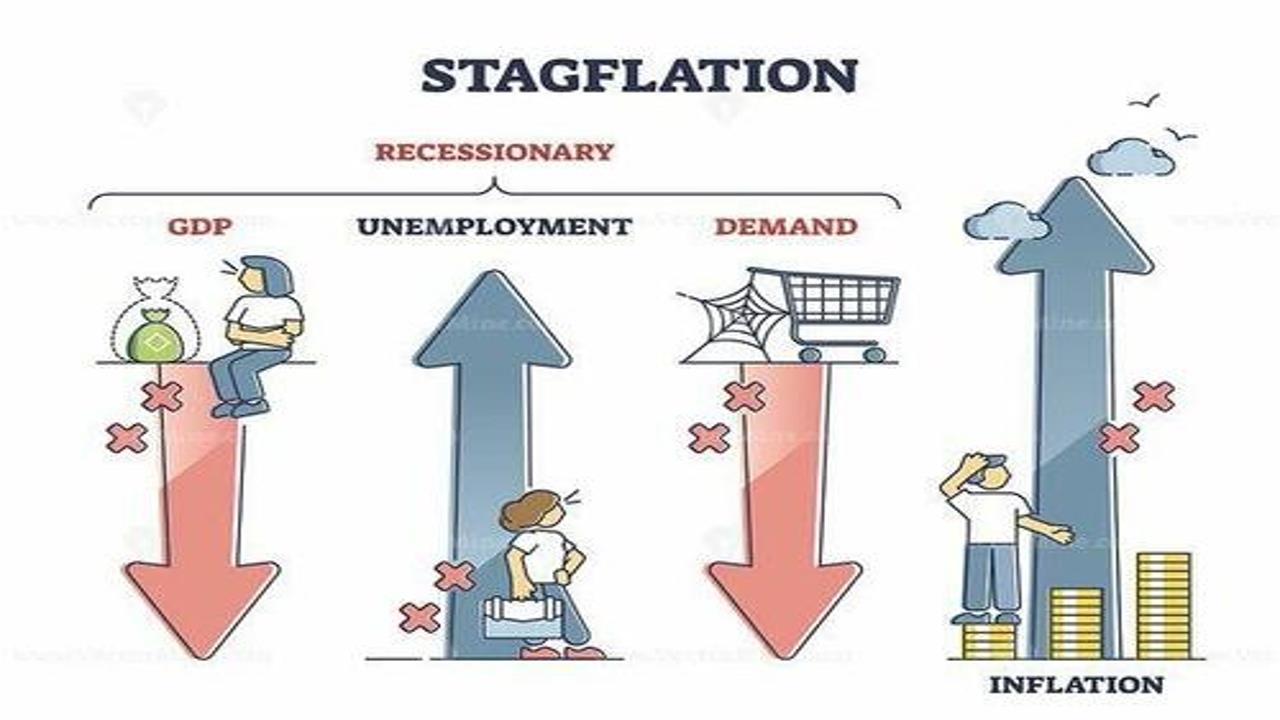

6) Unemployment Rate: The unemployment rate is a critical indicator of consumer health. Low unemployment generally signifies a strong job market and higher income levels, leading to increased consumer spending.

7) Real Wage Growth: Real wage growth considers the increase in wages adjusted for inflation. Positive real wage growth means that consumers have more purchasing power, while negative growth can limit their ability to spend.

8) Consumer Price Index (CPI): The CPI measures changes in the average prices of a basket of goods and services that consumers commonly purchase. Rising CPI indicates inflation, which can impact consumers' purchasing power.

9) Debt Payment Delinquency Rates: Monitoring rates of missed payments on loans and credit cards can provide insight into consumers' financial stress. Higher delinquency rates may indicate that consumers are struggling to meet their financial obligations.

These indicators collectively offer a comprehensive view of consumer health, reflecting their ability and willingness to spend, their confidence in the economy, and their overall financial well-being.

Chart:

References:

Comments