Video:

Take our online poll:

AI Analysis:

The U.S. dollar remains the world's primary reserve currency, and there hasn't been a significant shift away from it. However, the global financial landscape is subject to various economic, political, and geopolitical changes that could potentially impact the dollar's status as the dominant reserve currency.

Factors that could potentially influence the dollar's reserve currency status include:

1) Economic Stability: The relative strength and stability of the U.S. economy compared to other major economies can affect the attractiveness of the dollar as a reserve currency.

2) Geopolitical Developments: Geopolitical tensions and changes in international relations could impact the trust in the dollar as a stable and widely accepted currency.

3) International Trade Dynamics: Changes in global trade patterns and the rise of new economic powers could influence the demand for alternative currencies for trade settlement.

4) Alternative Currencies: The emergence and growth of alternative currencies, such as the euro, the Chinese yuan, and digital currencies, might provide alternatives for countries seeking to diversify their currency holdings.

5) Global Monetary Policy: Decisions made by central banks and international financial institutions could impact the attractiveness of the dollar for foreign exchange reserves.

6) Debt and Deficit Levels: High levels of U.S. government debt and deficits could potentially raise concerns about the long-term stability of the dollar.

It's important to note that while there have been discussions about potential challenges to the dollar's dominance, any shift in the global reserve currency landscape would likely be a gradual and complex process. Economic and geopolitical changes are inherently uncertain and can be influenced by a wide range of factors. To stay informed about developments in this area, it's advisable to follow reputable economic news sources, analyze expert opinions, and monitor trends in international finance and economics.

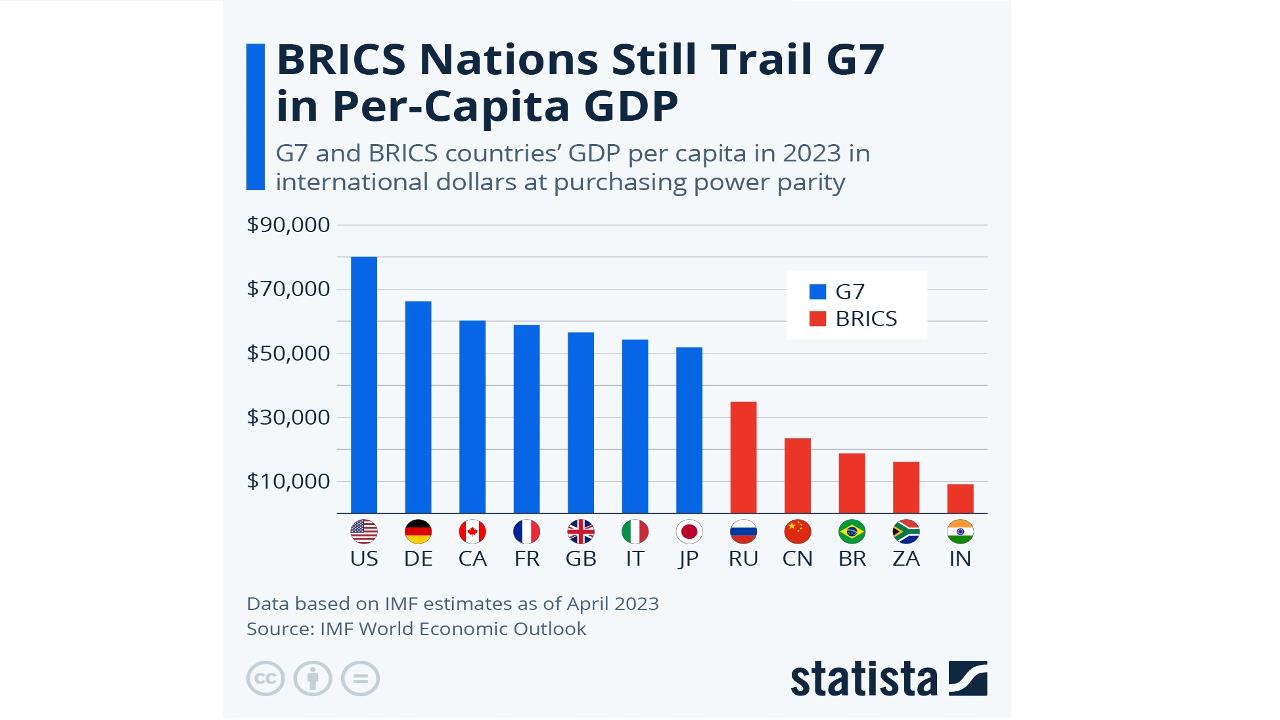

Chart:

References:

Comments