Video:

Take our online poll:

AI Analysis:

Achieving a balanced budget requires careful consideration of government spending and revenue. Here are five ways the U.S. could work towards a balanced budget:

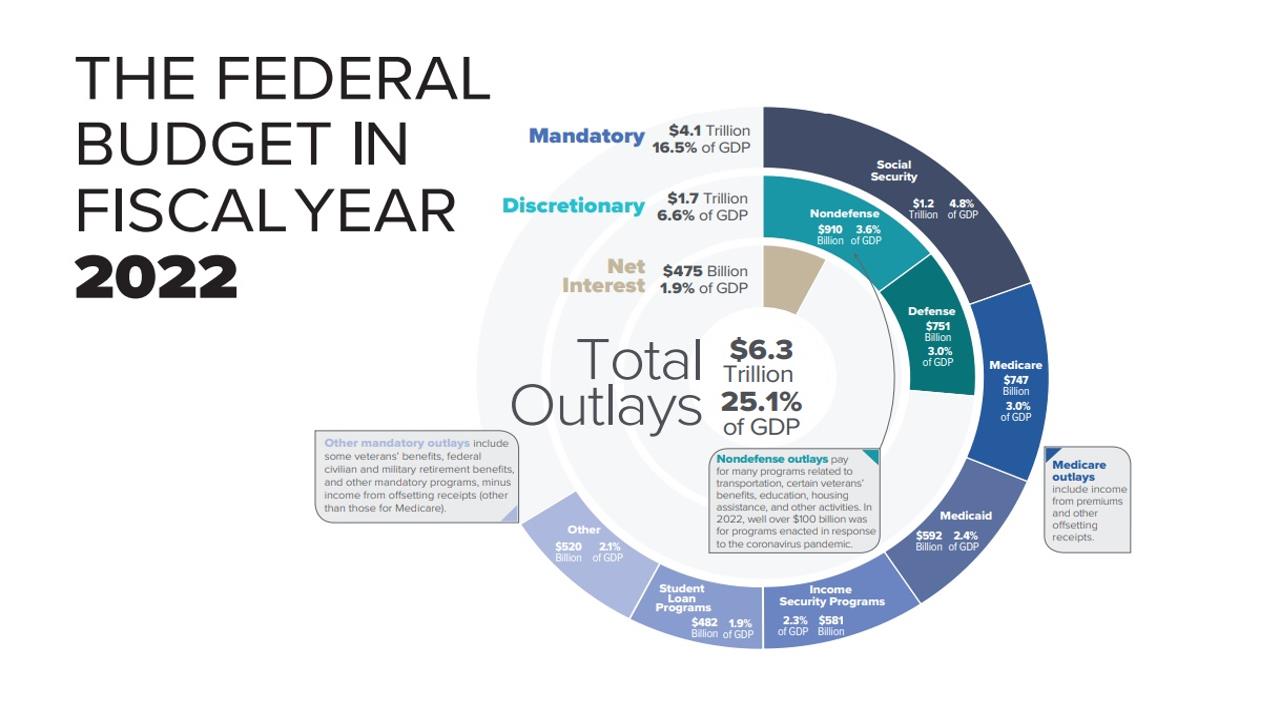

1) Reducing Government Spending: Identifying areas of excessive spending and making targeted cuts can help reduce the budget deficit. This might involve revisiting entitlement programs, discretionary spending, and military expenditures, and finding ways to make government operations more efficient.

2) Tax Reform and Revenue Generation: Reviewing the tax code and implementing reforms could increase government revenue. This might include closing loopholes, adjusting tax rates, and promoting economic growth to boost tax collections.

3) Economic Growth and Job Creation: A stronger economy can lead to increased tax revenue as more people are employed and businesses thrive. Policies that encourage investment, innovation, and job creation can contribute to a more balanced budget over time.

4) Addressing Mandatory Spending Programs: Social Security, Medicare, and other mandatory spending programs contribute significantly to the budget deficit. Exploring ways to reform these programs while ensuring they meet the needs of citizens could help control government expenditures.

5) Debt Management and Interest Reduction: Lowering the national debt and managing interest payments can free up funds that can be used elsewhere in the budget. This might involve prioritizing debt reduction and refinancing to take advantage of lower interest rates.

It's important to note that achieving a balanced budget is a complex task that requires a combination of strategies, often involving compromise and careful consideration of both short-term and long-term impacts on the economy and society.

Chart:

References:

Comments