Video:

Take our online poll:

AI Analysis:

The "problematic" level of public debt to GDP ratio can vary based on several factors, including the economic circumstances of a country, its growth potential, institutional factors, and investor sentiment. While there is no universally agreed-upon threshold, economists and policymakers often consider the following general guidelines:

1) Sustainability: A debt level is considered problematic when it becomes unsustainable, meaning the government is unable to service its debt obligations without resorting to excessive borrowing or defaulting. The exact threshold can vary depending on factors like economic growth, interest rates, and the country's ability to generate revenue.

2) 90% Rule: The idea that a debt to GDP ratio above 90% can have a negative impact on economic growth gained attention from studies like those by Carmen Reinhart and Kenneth Rogoff. However, this rule has faced criticism for methodological issues and oversimplification. It's important to note that not all countries experience negative effects above this threshold.

3) Market Sentiment: Investor perception and confidence play a significant role. If markets believe a country's debt is becoming unsustainable, borrowing costs can rise, leading to a self-fulfilling prophecy. Countries with higher credit ratings and investor trust might have more room to manage higher debt ratios.

4) Economic Growth: A country with strong economic growth potential can handle a higher debt burden more easily, as long as the debt remains manageable relative to the economy's growth rate.

5) Interest Rates: Low interest rates make it easier for governments to service their debt. High interest rates can strain government budgets and increase the burden of debt payments.

6) Policy Flexibility: A country with the ability to implement prudent fiscal and monetary policies has more leeway in managing higher debt levels.

7) Structural Factors: The nature of the debt (external vs. internal), the composition of spending (productive vs. unproductive), and the efficiency of public investments can impact how debt affects the economy.

8) Inflation: Moderate inflation can erode the real value of debt over time, making it more manageable.

It's important to consider debt in the context of the country's broader economic situation. What might be considered problematic for one country might not be the same for another. Sustainable debt management involves a balance between prudent borrowing for productive investments and avoiding excessive debt that can hinder economic growth and stability. Policymakers often strive to keep debt at levels that ensure long-term economic health and avoid crisis situations.

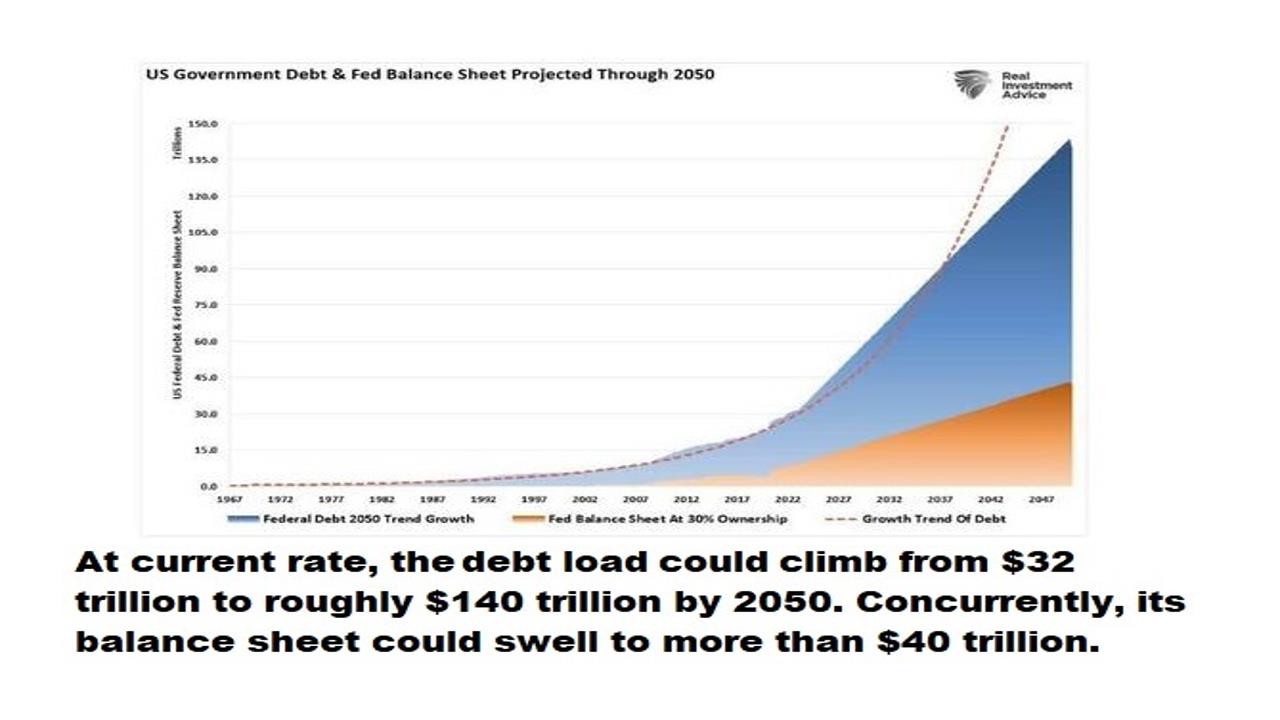

Chart:

References:

Comments