Video:

Take our online poll:

AI Analysis:

To determine how much money you would need to have saved for retirement to generate a monthly income of $4,345 at age 65, you need to consider several factors, including your life expectancy, expected rate of return on investments, and the withdrawal rate. Let's assume a few parameters to calculate an estimate:

1) Life Expectancy: Let's assume a life expectancy of 85 years. This means you'll need to plan for 20 years of retirement.

2) Expected Rate of Return: Let's assume a conservative rate of return of 5% per year on your investments after retirement.

3) Withdrawal Rate: A commonly used safe withdrawal rate is around 4% per year. This rate ensures that you have a high likelihood of not running out of money during your retirement years.

With these assumptions, we can use the "Rule of 25" to estimate the required retirement savings. The Rule of 25 suggests that you should aim to save 25 times your annual retirement expenses to maintain a 4% withdrawal rate. Here's the calculation:

Required Retirement Savings = (Annual Retirement Income) x (Rule of 25)

Annual Retirement Income = $4,345 x 12 = $52,140 Required Retirement Savings = $52,140 x 25 = $1,303,500

According to these assumptions, you would need to have approximately $1,303,500 saved for retirement at age 65 to generate a monthly income of $4,345 for 20 years. Keep in mind that this is a rough estimate, and individual circumstances may vary. It's essential to work with a financial advisor to create a comprehensive retirement plan based on your specific goals, risk tolerance, and financial situation.

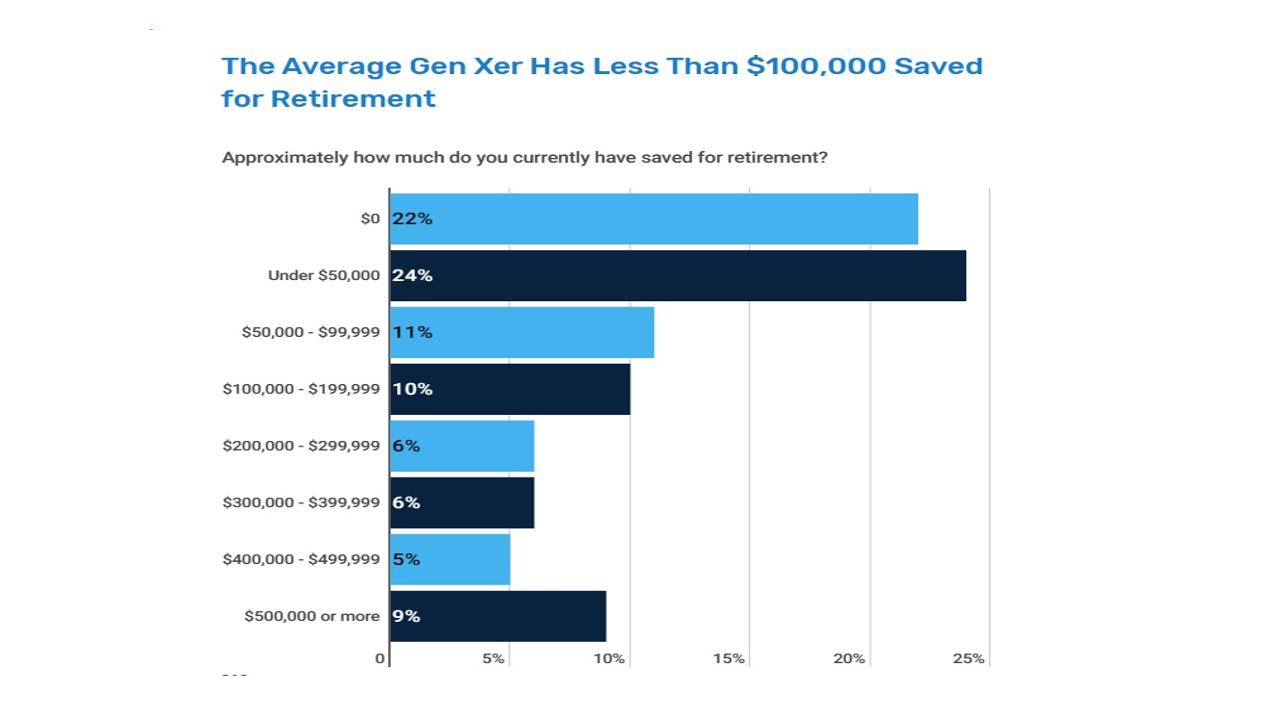

Chart:

References:

Comments