Video:

Take our online poll:

AI Analysis:

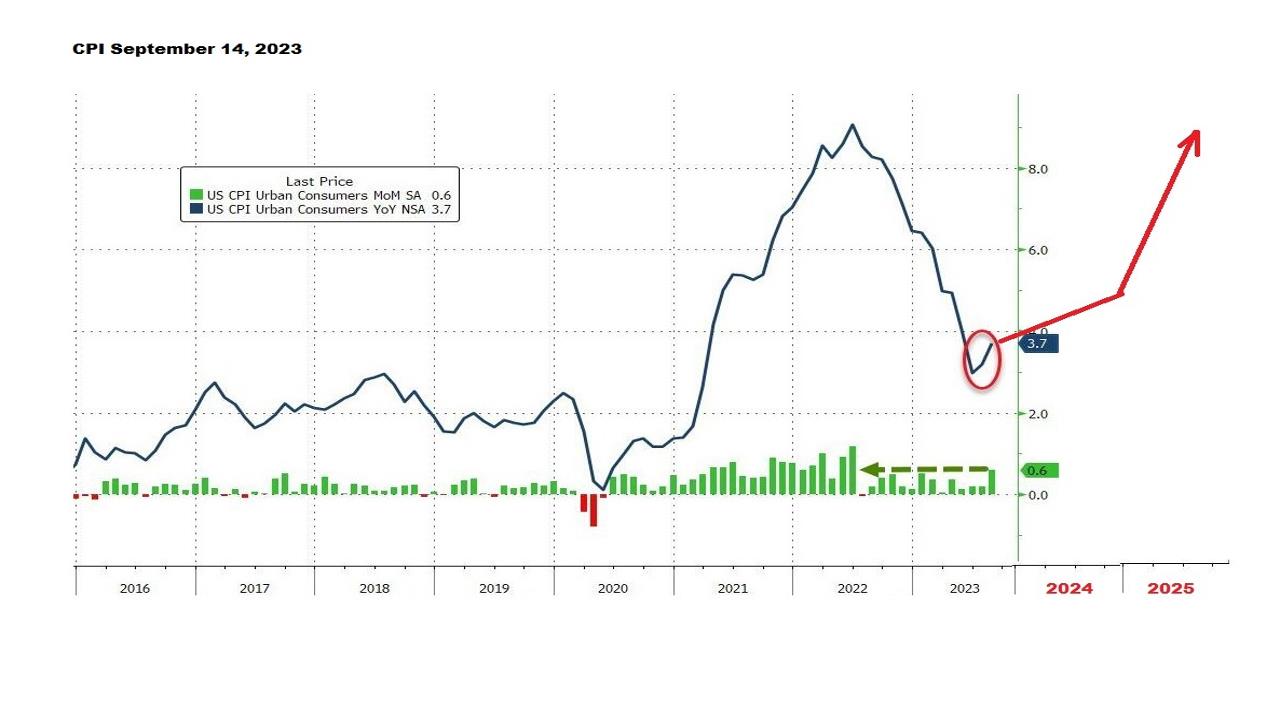

The difference between reported Consumer Price Index (CPI) inflation and the inflation experienced by individuals "on the street" can be influenced by several factors. It's important to understand that CPI is a statistical measure that provides an average of price changes for a basket of goods and services that represent the typical consumption patterns of a broad population. Here are some reasons for the perceived difference:

1) Composition of the CPI Basket: The CPI basket may not reflect the specific spending patterns of an individual or household. People have different consumption habits, and the CPI basket represents an average. If your spending differs significantly from the items in the basket, your personal inflation rate may be higher or lower.

2) Geographic Variations: CPI is a national average, and inflation rates can vary widely by region. Housing costs, for example, can vary significantly from one city or state to another. If you live in an area with rapidly rising housing costs, your personal inflation experience may differ from the national average.

3) Substitution Effects: The CPI assumes that consumers will make substitutions in response to price changes. For example, if the price of one brand of cereal rises significantly, consumers may switch to a cheaper brand. This substitution effect can dampen the CPI increase compared to the real-world experience of some individuals.

4) Quality Adjustments: CPI tries to account for changes in the quality of goods and services. If a product improves in quality (e.g., a smartphone with better features), its price increase in the CPI may be adjusted downward. However, if you don't perceive the improvement in quality, it may seem like prices are rising faster.

5) Omission of Certain Expenses: The CPI basket may not include all expenses that individuals face, such as healthcare costs or education expenses. If these expenses are rising faster than items included in the CPI, it can lead to a perception of higher inflation.

6) Timing of Data Collection: CPI data is collected and reported periodically (typically monthly). Some price increases may occur between reporting periods, leading to a perception of faster rising prices.

7) Perception vs. Statistics: Inflation perception can be influenced by psychological factors. If individuals perceive that prices are rising rapidly or if they are constantly exposed to news about rising prices, their perception of inflation may not align with the statistical measurement.

8) Supply Chain Disruptions: Events such as supply chain disruptions or shortages can lead to localized price spikes that may not be fully captured in the CPI.

It's essential to recognize that while CPI is a valuable tool for measuring inflation on an aggregate level, individuals and households may have unique experiences based on their spending patterns and geographic location. Additionally, inflation can be influenced by a complex interplay of economic factors, making it challenging to precisely match personal experiences with the CPI.

Chart:

References:

Comments