Video:

Take our online poll:

AI Analysis:

Historically, stocks have generally been considered a reasonable hedge against inflation over the long term, but their effectiveness can vary depending on several factors. Here's an overview of how stocks can function as an inflation hedge:

1) Inherent Inflation Protection: Stocks represent ownership in companies, and these companies typically have the ability to adjust their prices and earnings in response to inflation. When prices for goods and services rise due to inflation, companies can often increase the prices of their products or services, which can lead to higher revenues and profits.

2) Dividend Income: Many stocks pay dividends to their shareholders. These dividends can provide a source of income that may keep pace with or even outpace inflation over time. Some companies have a history of raising their dividend payouts regularly, which can enhance their role as an inflation hedge.

3) Capital Appreciation: Stocks can also offer potential for capital appreciation over time, as the value of the shares may increase. While stocks can be volatile in the short term, historically, they have shown an ability to provide real (inflation-adjusted) returns over longer investment horizons.

4) Diversification: Investing in a diversified portfolio of stocks can help spread risk and improve the chances of maintaining purchasing power in an inflationary environment. Different industries and sectors may be affected differently by inflation, and diversification can help mitigate the impact.

However, it's important to consider the following factors when assessing the effectiveness of stocks as an inflation hedge:

1) Inflation Variability: The ability of stocks to hedge against inflation can vary depending on the level and nature of inflation. High and unexpected inflation can erode purchasing power and reduce real returns from stocks, particularly if it leads to higher interest rates.

2) Time Horizon: The effectiveness of stocks as an inflation hedge tends to improve with a longer investment horizon. Short-term market fluctuations can be significant, so stocks may not always provide immediate protection against inflation.

3) Stock Selection: Not all stocks will react to inflation in the same way. Companies with strong pricing power and the ability to pass on higher costs to consumers may perform better in inflationary periods. Investors need to select stocks carefully.

4) Interest Rates: In some cases, central banks may respond to high inflation by raising interest rates, which can have an impact on stock prices. Rising interest rates can increase borrowing costs for companies and potentially slow economic growth.

Overall, while stocks historically have the potential to offer a degree of inflation protection and can be a valuable component of a diversified portfolio, it's important to remember that they come with inherent market risk and may not provide guaranteed protection in all inflationary scenarios. Diversification, asset allocation, and a long-term perspective are essential strategies to manage the impact of inflation on your investment portfolio.

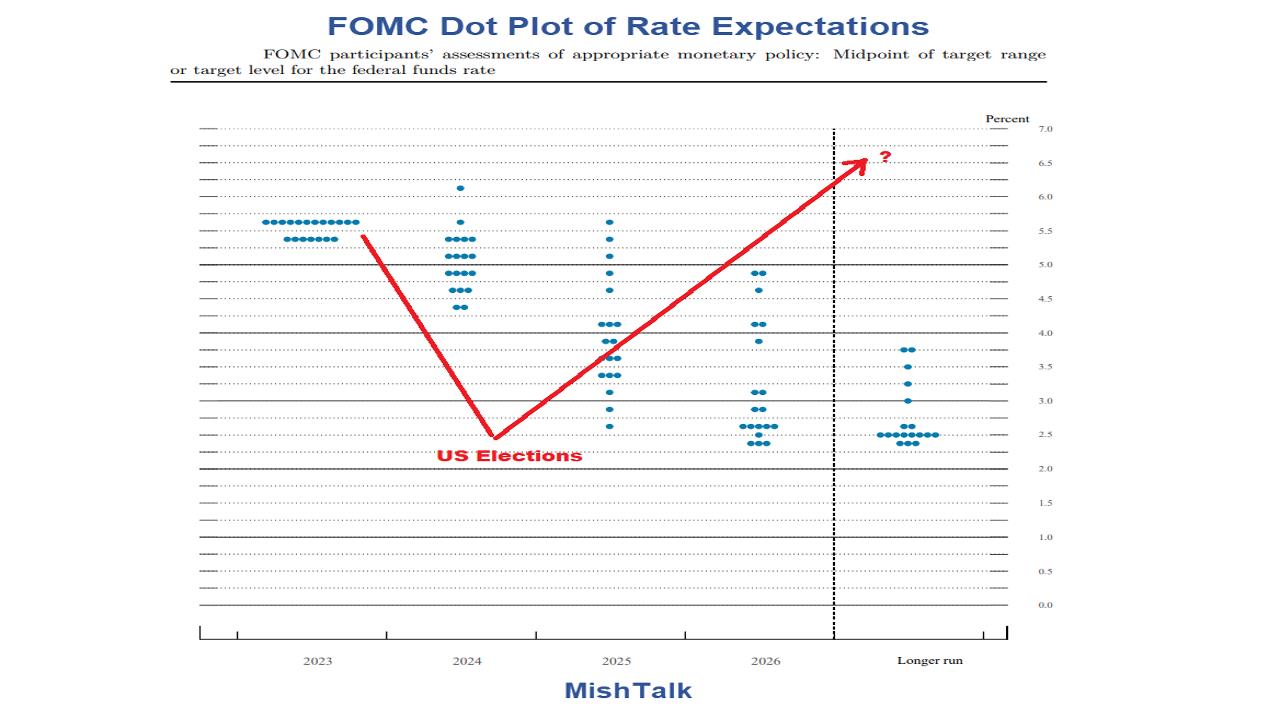

Chart:

References:

Comments