Video:

Take our online poll:

AI Analysis:

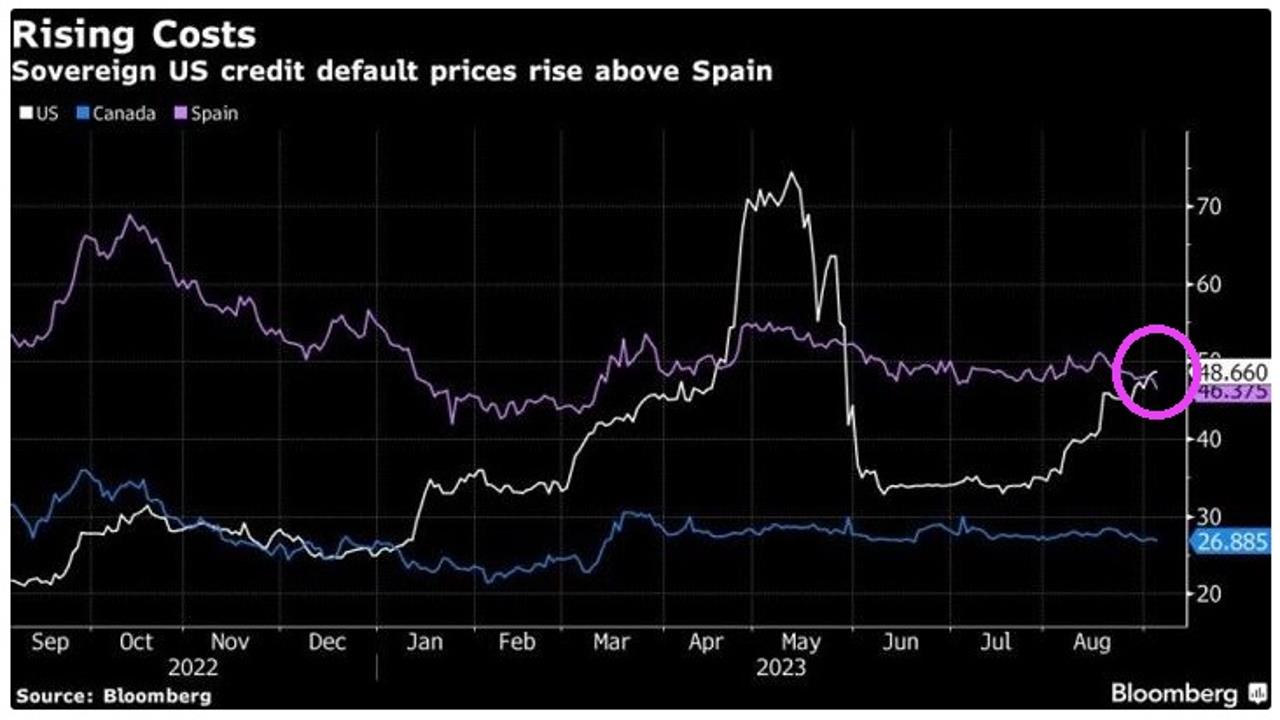

A sudden rise in Credit Default Swaps (CDS) can indicate increased perceived risk in the credit markets and pose several dangers:

1) Financial Instability: A significant CDS spike may signal concerns about the creditworthiness of companies or institutions. This can lead to uncertainty and panic in financial markets, potentially causing instability.

2) Credit Risk: Rising CDS prices can make it more expensive for companies to borrow money. It can also lead to credit downgrades, making it difficult for them to access capital, which can hinder business operations and growth.

3) Systemic Risk: If CDS spreads widen across multiple financial institutions, it can indicate a systemic issue. This can trigger a domino effect, potentially leading to a financial crisis like the one seen in the 2008 global financial crisis.

4) Investor Losses: Investors holding CDS contracts may face significant losses as the value of these contracts declines. This can impact not only institutional investors but also individual investors through mutual funds or pension plans.

5) Economic Contraction: Widespread concerns reflected in rising CDS prices can result in reduced lending, lower economic activity, and a potential recession, as companies become more cautious about investments and expansion.

6) Regulatory Scrutiny: Regulatory authorities may increase oversight and impose stricter regulations in response to rising CDS levels, impacting financial institutions' profitability and operations.

It's essential to closely monitor CDS movements as they can provide valuable insights into market sentiment and potential risks to the financial system. However, it's important to note that CDS prices alone do not always lead to negative outcomes; they should be considered alongside broader economic and financial indicators for a more comprehensive assessment of the situation.

Chart:

References:

Comments