Video:

Take our online poll:

AI Analysis:

The likelihood of the U.S. dollar losing its global reserve currency status is a complex and debated topic. While it is challenging to predict with certainty, there are several factors to consider:

1) Economic Stability: The stability of the U.S. economy is a crucial factor. If the U.S. experiences a significant economic crisis, it could erode confidence in the dollar's status.

2) Global Economic Shifts: The rise of emerging economies, such as China, as significant global players may lead to a shift away from the dollar if these economies offer viable alternatives.

3) Geopolitical Events: Geopolitical tensions and conflicts can influence global perceptions of the dollar's stability and safety.

4) International Agreements: The adoption of alternative currencies or the creation of new international financial institutions can also impact the dollar's status.

5) Market Forces: Currency markets and the behavior of central banks play a role. Central banks' decisions to diversify their foreign exchange reserves can affect the dollar's status.

6) Investor Confidence: The confidence of international investors in the U.S. financial markets and the safety of dollar-denominated assets is crucial.

7) U.S. Fiscal and Monetary Policies: The fiscal and monetary policies of the U.S. government and its ability to manage its debt can impact the dollar's standing.

8) Alternatives to the Dollar: The development of alternatives to the dollar, such as digital currencies or the use of other national currencies in international trade, can influence its role.

It's important to note that while the dollar's status as the world's primary reserve currency has faced challenges and debates, it remains the dominant global reserve currency at the time of my last knowledge update in September 2021. The U.S. government and central banks worldwide take steps to maintain the stability and desirability of the dollar in international trade and finance.

The dollar's status as the global reserve currency has endured for decades due to the size and stability of the U.S. economy, the depth of its financial markets, and the trust in U.S. institutions. However, the global financial landscape is subject to change, and shifts can occur over time. These changes are influenced by a combination of economic, geopolitical, and market factors.

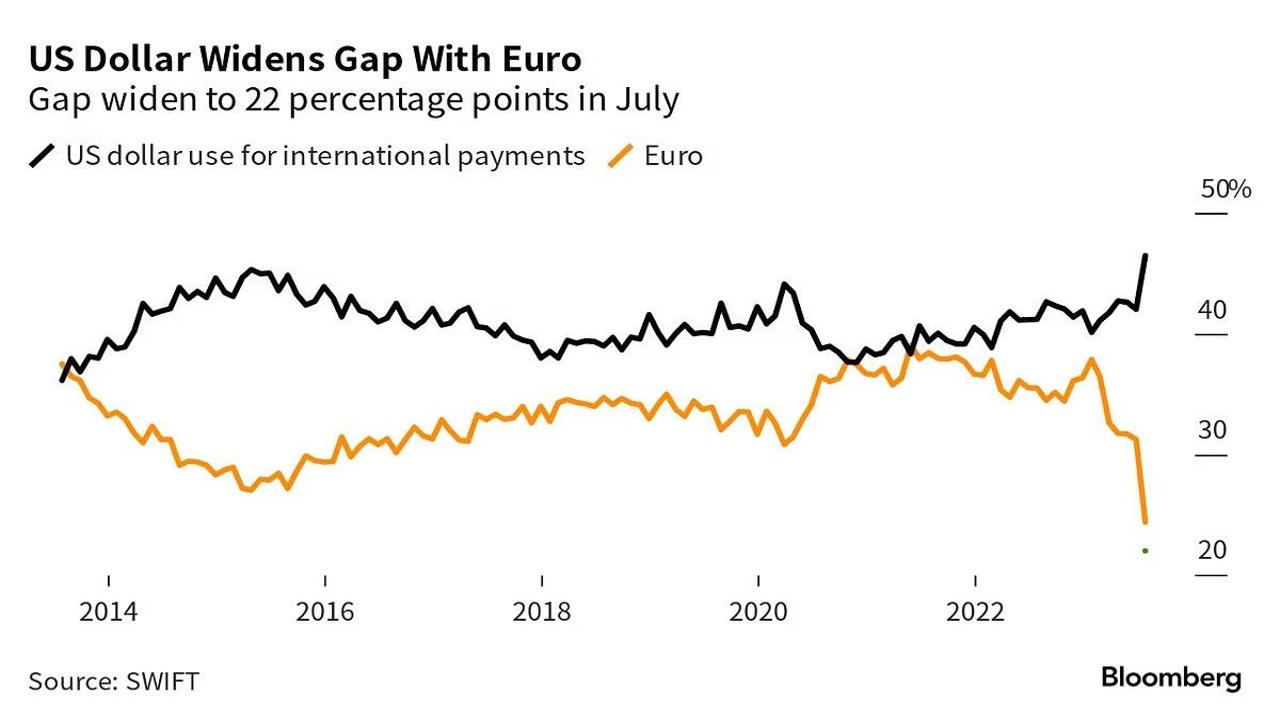

Chart:

References:

Comments