Video:

Take our online poll:

AI Analysis:

The formula used to calculate the amount of Social Security payments an individual might receive when they retire depends on several factors, including the individual's earnings history, the age at which they choose to begin receiving benefits, and other personal circumstances. Here is a simplified explanation of how Social Security retirement benefits are calculated:

1) Calculate the Average Indexed Monthly Earnings (AIME):

The AIME is determined by taking the individual's highest 35 years of indexed earnings. Indexed earnings account for inflation and are adjusted to current wage levels. If an individual has fewer than 35 years of earnings, zeros are included for the missing years.

The total earnings from these 35 years are added up, and then this sum is divided by 420 (the number of months in 35 years) to get the AIME.

2) Apply the Benefit Formula:

The AIME is then used in a formula to calculate the Primary Insurance Amount (PIA), which is the basic amount an individual is entitled to at their full retirement age (FRA). FRA is typically between 65 and 67, depending on the year of birth.

The benefit formula is typically adjusted annually, so it's essential to check the most current formula from the Social Security Administration (SSA). As of my last knowledge update in September 2021, the formula was as follows:

- For the first portion of the AIME, you receive 90% of your AIME.

- For the portion of the AIME between a certain "bend point" (a specific dollar amount adjusted for inflation) and the maximum bend point, you receive 32%.

- For the portion of the AIME above the maximum bend point, you receive 15%.

The specific bend points and percentages used in the formula can change from year to year, and the SSA uses a calculation to determine your PIA based on these factors.

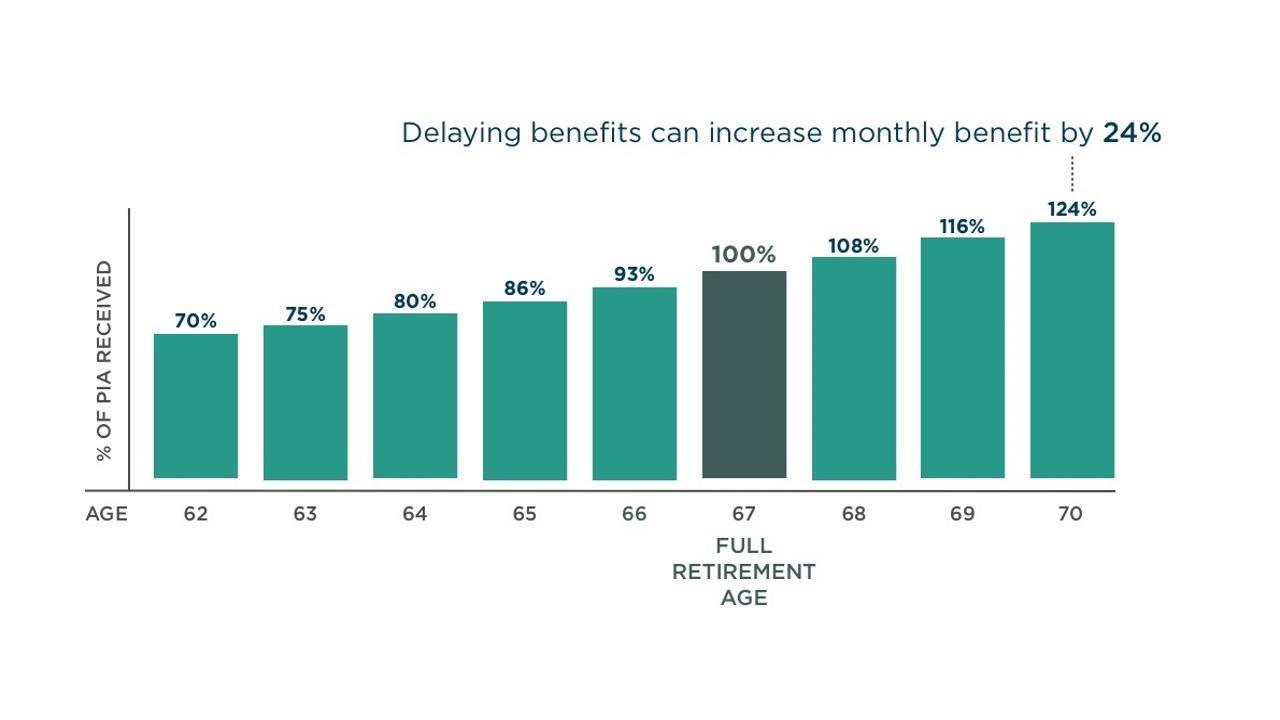

3) Adjust for Early or Delayed Retirement:

- If you start receiving benefits before your FRA (as early as age 62), your monthly benefit amount will be reduced. Conversely, if you delay receiving benefits past your FRA, your monthly benefit amount will be increased.

4) Other Factors:

- Your marital status, spousal benefits, and other factors can also affect your Social Security benefits. There are additional calculations for spousal benefits and survivor benefits, which depend on various circumstances.

It's important to note that Social Security rules and benefit calculations can change over time. For the most accurate and up-to-date estimate of your Social Security retirement benefits, it is recommended to use the Social Security Administration's online calculator or consult with the SSA directly.

Chart:

References:

Social Security Benefit Average

Comments