Video:

Take our online poll:

AI Analysis:

Downsizing and cutting personal costs can be challenging, but there are various strategies you can adopt to manage your finances more effectively. Here are some ways to cut personal costs in an economy that requires downsizing:

(1) Create a Budget: - Develop a detailed budget outlining your income and expenses. - Categorize your spending to identify areas where you can make cuts.

(2) Prioritize Expenses: -Differentiate between essential and non-essential expenses. - Prioritize spending on necessities like housing, utilities, food, and healthcare.

(3) Reduce Housing Costs: - Consider downsizing your living space or relocating to a more affordable area. - Explore refinancing options for your mortgage to lower monthly payments.

(4) Cut Transportation Costs: - Use public transportation, carpool, or bike to reduce fuel and maintenance costs. - Consider downsizing to a more fuel-efficient vehicle.

(5) Evaluate Subscriptions and Memberships: - Review and cancel unnecessary subscriptions (e.g., streaming services, magazines). - Evaluate the cost-benefit of memberships and consider canceling those you don't frequently use.

(6) Save on Utilities: -Implement energy-saving practices to reduce utility bills.

Shop around for better rates on internet, cable, and phone services. (7) Shop Smart: - Look for discounts, use coupons, and buy in bulk to save on groceries. - Compare prices before making major purchases and consider buying second-hand.

(8) Reduce Entertainment Expenses: - Find low-cost or free entertainment options. - Limit dining out and consider cooking at home.

(9) Review Insurance Policies: - Shop around for insurance to find the best rates. - Consider adjusting coverage levels to reduce premiums.

(10) Cut Unnecessary Expenses: - Identify and eliminate non-essential spending, such as impulse purchases. - Review your discretionary spending and find areas to cut back.

(11) Negotiate Bills: - Negotiate with service providers for better rates. - Inquire about hardship programs or discounts for financial difficulties.

(12) Emergency Fund: - Build and maintain an emergency fund to cover unexpected expenses. - Having savings can prevent you from going into debt during tough times.

(13) Explore Additional Income Streams: - Look for part-time or freelance work to supplement your income. - Consider monetizing hobbies or skills.

(14) Debt Management: - Develop a plan to pay down high-interest debt. - Negotiate with creditors for lower interest rates or payment plans.

(15) Financial Counseling: - Seek advice from financial counselors or advisors to help you navigate challenging financial situations.

Remember, the key to successful downsizing is to carefully evaluate your spending habits, prioritize your needs, and make informed decisions about where to cut costs. It may take time to adjust, but these strategies can help you manage your finances more effectively during challenging economic periods.

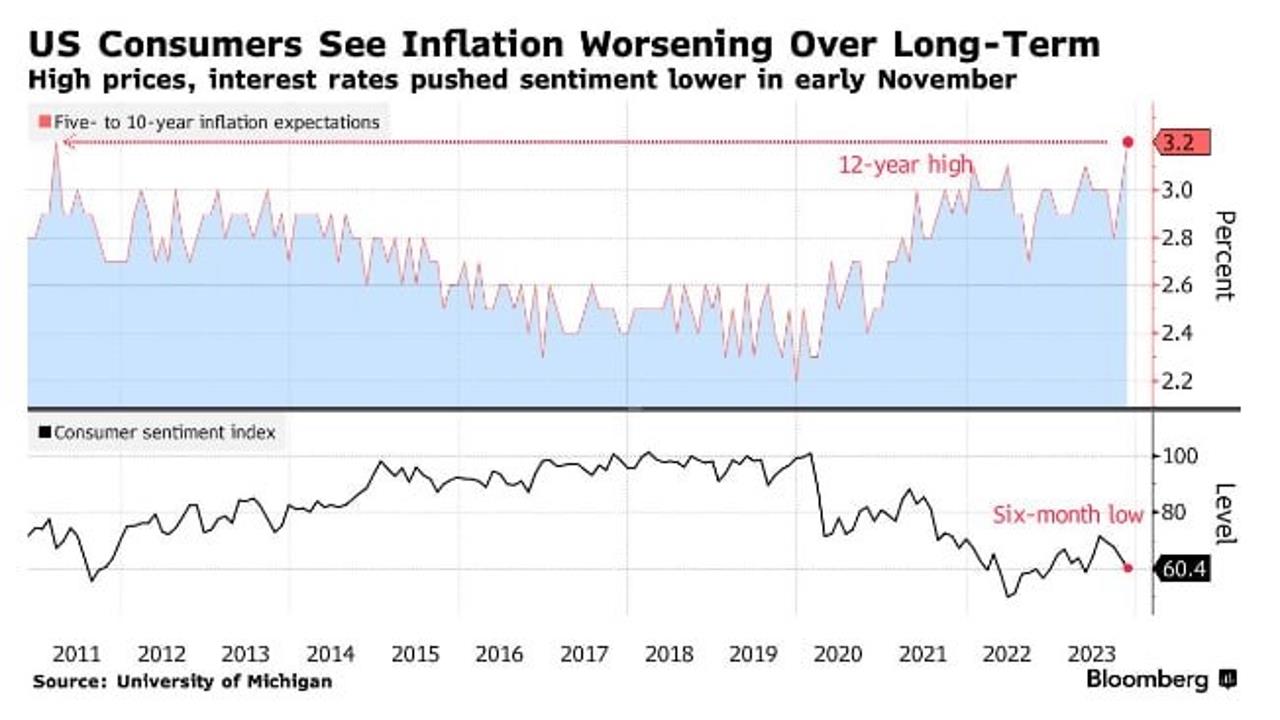

Chart:

References:

Comments