Video:

Take our online poll:

AI Analysis:

Warren Buffett's characterization of derivatives as "financial weapons of mass destruction" stems from the complexity and risks associated with these financial instruments. Derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or entity. They can be used for various purposes, including hedging against risks, speculating on price movements, or gaining exposure to different markets.

Buffett's concern revolves around several aspects of derivatives:

1) Complexity and Lack of Understanding: Derivatives can be highly complex, involving intricate structures and financial engineering. Their complexity can make them difficult to understand and evaluate, leading to risks for investors who might not fully comprehend the instruments they are dealing with.

2) Leverage and Amplified Risks: Derivatives often involve leverage, meaning a small change in the underlying asset's value can lead to significant gains or losses in the derivative's value. This amplification of risks can lead to substantial financial losses if not managed properly.

3) Counterparty Risk: Derivatives typically involve agreements between parties (counterparties), and the performance of these contracts relies on the creditworthiness and reliability of those counterparties. If a counterparty fails to meet its obligations, it can lead to significant financial disruptions.

4) Systemic Risk: The interconnectedness of financial institutions and markets through derivatives can potentially contribute to systemic risk. A crisis or failure in one part of the financial system could have cascading effects, impacting other institutions and markets.

Buffett's warning underscores the importance of understanding the risks associated with derivatives and the need for proper risk management and regulation within the financial industry. While derivatives can serve legitimate purposes for risk management and investment strategies, their complexity and potential for unintended consequences require careful handling and oversight to avoid systemic disruptions.

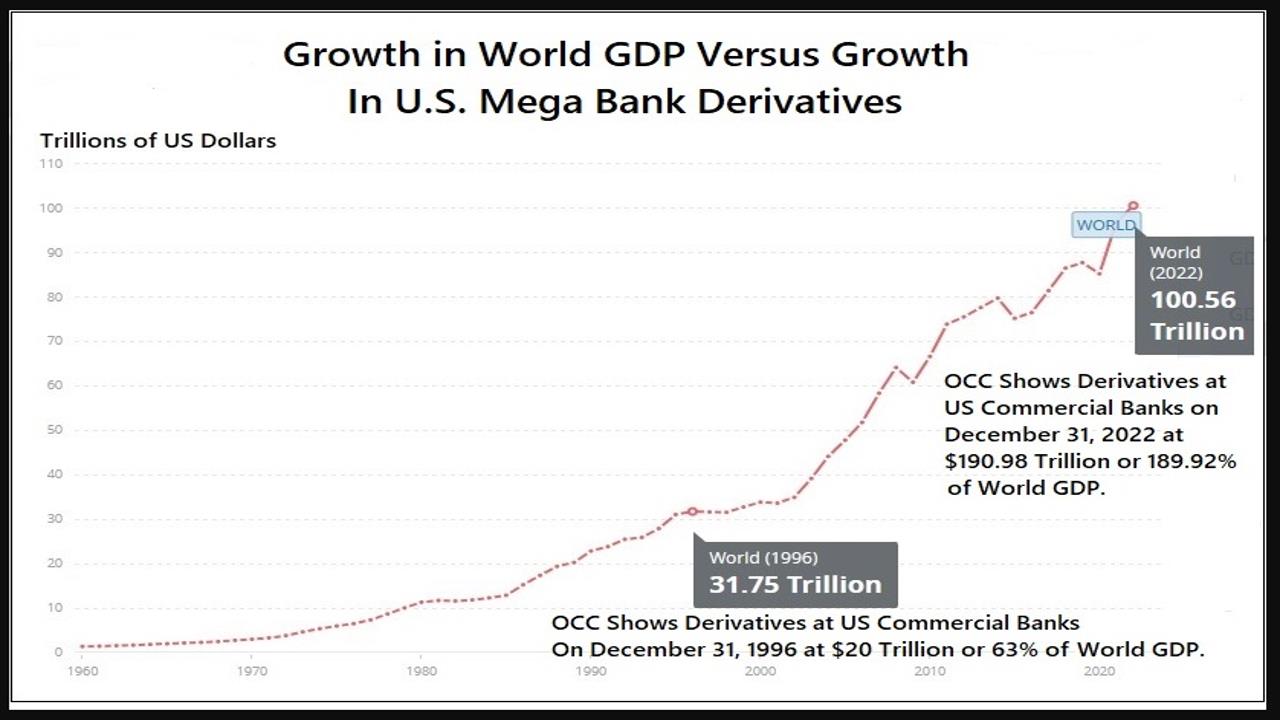

Chart:

References:

Comments