Video:

Take our online poll:

AI Analysis:

The relationship between gold prices and interest rates can be complex and multifaceted, influenced by various factors and market dynamics. However, there are some general associations:

1) Inverse Relationship with Real Interest Rates: Gold is often seen as a hedge against inflation and currency depreciation. When real interest rates (interest rates adjusted for inflation) are low or negative, the opportunity cost of holding non-interest-bearing assets like gold decreases. As a result, gold becomes relatively more attractive, potentially leading to an increase in its price.

2) Interest Rates and Opportunity Cost: Higher interest rates can increase the opportunity cost of holding gold since it doesn’t provide any yield or interest. When interest rates rise, investors might shift their investments towards interest-bearing assets like bonds or savings accounts, reducing demand for gold and potentially leading to a decrease in its price.

3) Market Expectations: Anticipation of changes in interest rates by central banks or changes in monetary policy can influence market sentiment. Expectations of interest rate cuts, for example, might lead investors to move towards assets like gold, anticipating a potential decrease in the value of currencies or seeking safe-haven investments.

4) Currency Strength and Gold Prices: Gold is traded in US dollars, so fluctuations in currency values can also affect its price. When interest rates rise, it can strengthen the currency, potentially leading to a decrease in gold prices. Conversely, lower interest rates might weaken the currency, making gold relatively more attractive.

These relationships are not always straightforward and can be influenced by a range of other factors such as geopolitical tensions, market sentiment, global economic conditions, and investor behavior. While there are correlations between gold prices and interest rates, the relationship is just one of many factors that impact the price of gold in the complex global financial markets.

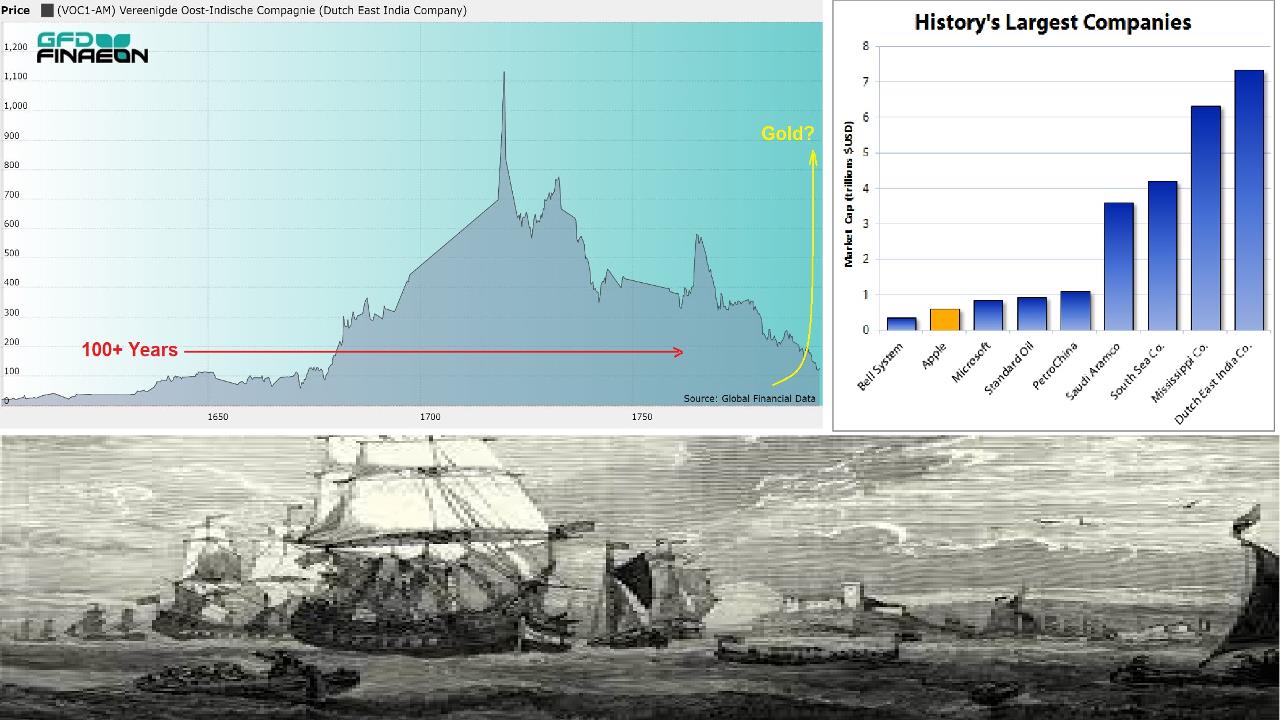

Chart:

References:

Comments