Video:

Take our online poll:

AI Analysis:

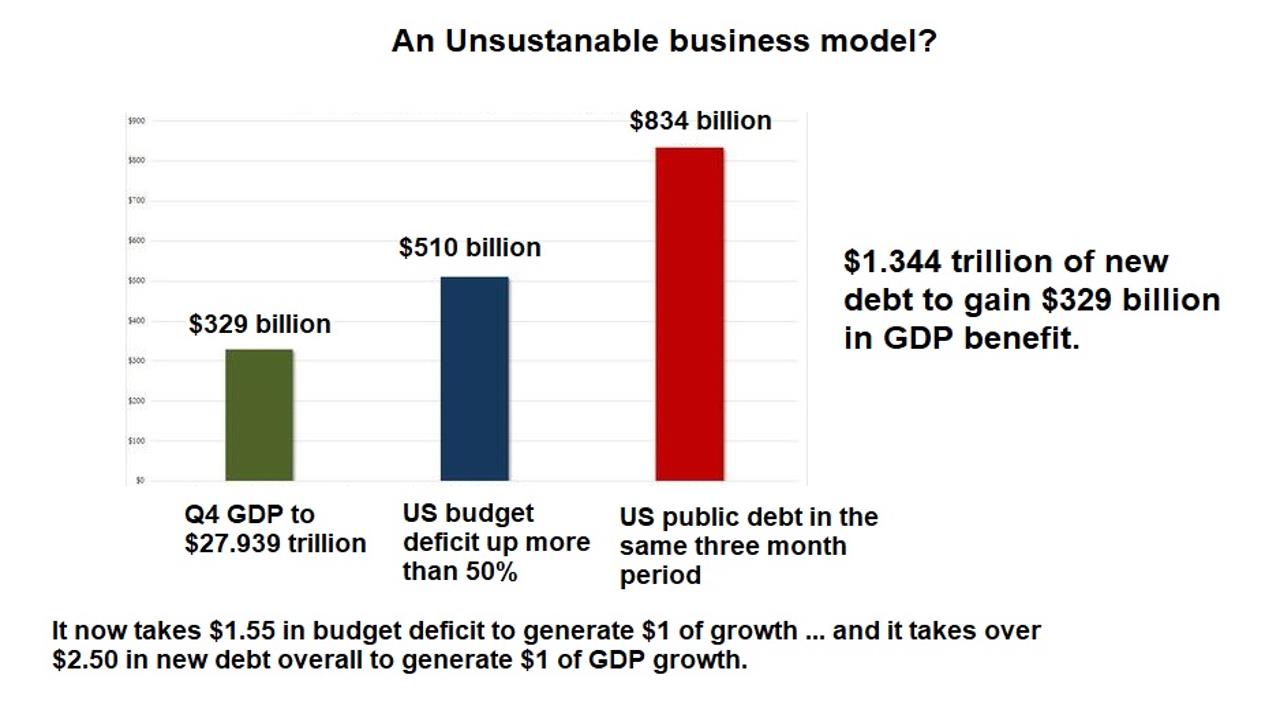

The sustainability and reasonableness of a business model depend on various factors beyond the simple financial figures provided. While gaining $329 billion in benefit sounds substantial, going into debt by $1.344 trillion raises concerns about the overall financial health and feasibility of the business model.

Key considerations include:

Debt Servicing: Can the business generate enough revenue to cover the costs of servicing the significant debt incurred? High levels of debt may lead to substantial interest payments.

Profitability: Is the $329 billion in benefits sufficient to cover operating costs, debt servicing, and still yield a reasonable profit?

Market Conditions: Are there external factors, such as economic conditions or industry trends, that could impact the business's ability to generate revenue and repay debt?

Long-Term Viability: Can the business sustain its operations and profitability over the long term, or does the model rely on short-term gains that may not be sustainable?

Risks and Uncertainties: Are there significant risks or uncertainties that could affect the business model, such as regulatory changes, market competition, or technological shifts?

Return on Investment (ROI): Does the expected return on investment justify the level of debt taken on? Assessing the ROI helps determine if the business model is financially sound.

It's crucial to conduct a comprehensive financial analysis, consider risk factors, and assess the feasibility of the business model over the long term. Going into substantial debt requires careful planning, risk management, and a clear strategy for generating revenue and repaying obligations. Consulting with financial experts or advisors can provide valuable insights into the viability of such a business model.

Chart:

References:

Comments