Video:

Take our online poll:

AI Analysis:

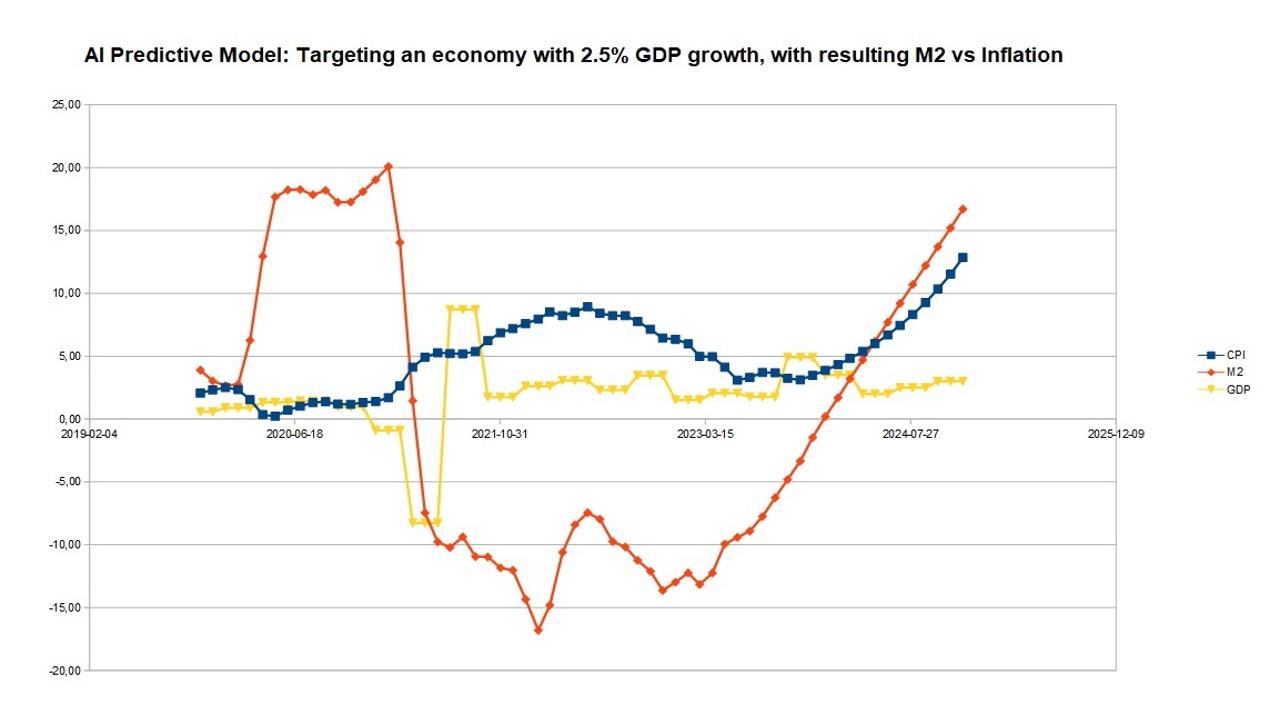

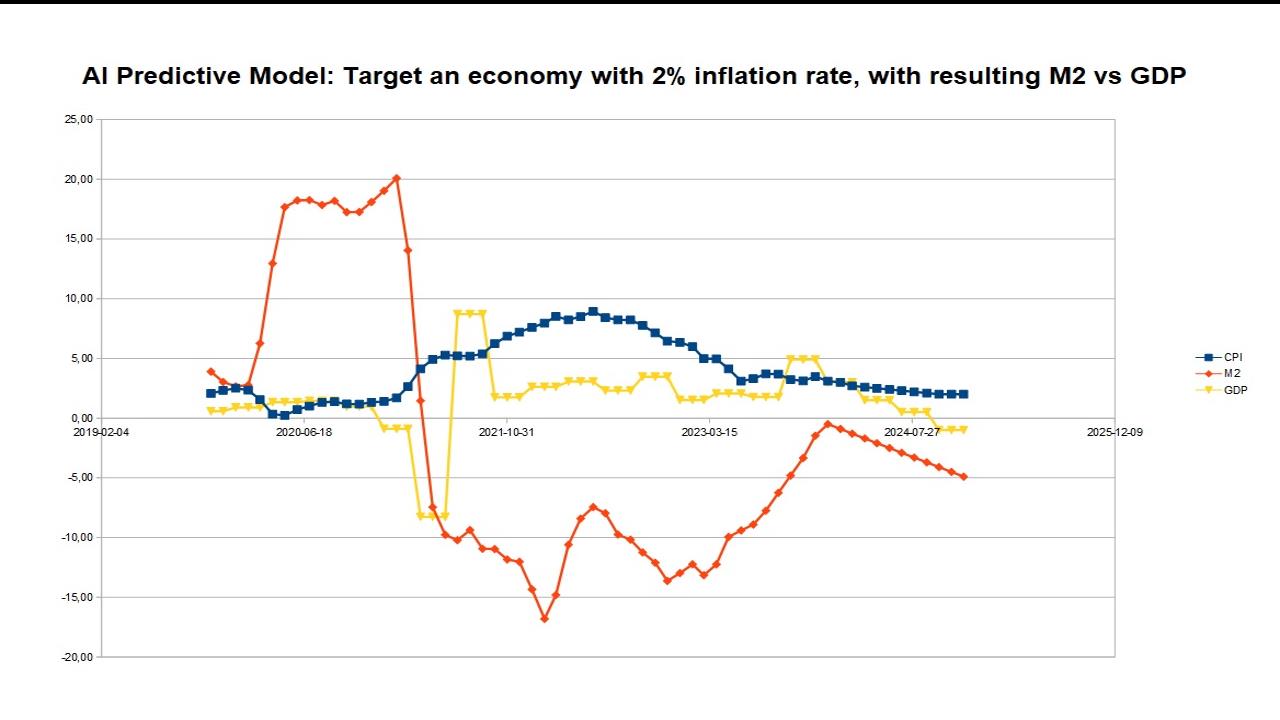

To target a specific GDP growth rate of 2.5% annually using the M2 money supply and inflation rates, you'd typically aim to create a model that relates these variables. However, a simple formula to represent the relationship between GDP growth, M2 money supply, and inflation rates could involve the following:

GDP Growth = M2 Money Supply Growth − Inflation Rate

For instance, if you assume that the M2 money supply growth directly contributes to economic growth, and inflation has a negative impact on GDP growth, this simplified formula might represent your hypothesis.

However, creating a precise formula to target a specific GDP growth rate using M2 money supply and inflation rates would likely involve more complex economic models and multiple factors, as GDP growth depends on various economic indicators beyond just M2 and inflation.

To build a more accurate model, economists often use regression analysis, time series models, or other sophisticated economic modeling techniques to understand the relationship between these variables and predict GDP growth rates. This allows for a more nuanced approach, considering the interplay of multiple economic factors that influence GDP growth.

The basic formula for the value of money is typically associated with the Quantity Theory of Money, which expresses the relationship between the money supply, the velocity of money, the price level, and real output in an economy. This theory is often represented as:

MV=PQ

Where:

M stands for the money supply in an economy. V represents the velocity of money, which indicates how fast money circulates in the economy. P represents the price level, reflecting the average prices of goods and services. Q denotes the real output or quantity of goods and services produced.

The Quantity Theory of Money is foundational in understanding the relationship between the quantity of money in circulation and the general price level in an economy. It indicates that changes in the money supply can influence inflation or deflation when other factors like the velocity of money and real output remain constant. However, it's important to note that in real-world economic scenarios, the velocity of money and real output are not fixed, and numerous other factors also influence the value and behavior of money.

Chart:

References:

Comments