Video:

Take our online poll:

AI Analysis:

Economists can often get forecasts wrong due to a variety of factors, some of which include:

Complexity of the Economy: Economies are incredibly complex systems with numerous variables that interact in dynamic ways. It's challenging for economists to accurately predict how these variables will evolve and how they will influence each other.

Uncertainty: Economic forecasts are inherently uncertain due to unpredictable events such as natural disasters, geopolitical tensions, or sudden shifts in consumer behavior. These uncertainties can significantly impact the accuracy of forecasts.

Incomplete Data: Economists rely on historical data to make forecasts, but sometimes the data is incomplete or inaccurate. This can lead to flawed predictions, especially when key variables are not properly accounted for.

Assumptions and Models: Economic forecasts are often based on economic models that make simplifying assumptions about how the economy works. If these assumptions are incorrect or the models fail to capture important dynamics, the forecasts can be off-target.

Behavioral Factors: Human behavior plays a crucial role in economic outcomes, but it can be difficult to predict. Factors such as changes in consumer sentiment, investor confidence, or government policy responses can have significant effects on the economy but are challenging to quantify accurately in forecasts.

These are just a few reasons why economists frequently encounter difficulties in making accurate forecasts. Despite advances in economic theory and data analysis techniques, forecasting the economy remains an inherently uncertain endeavor.

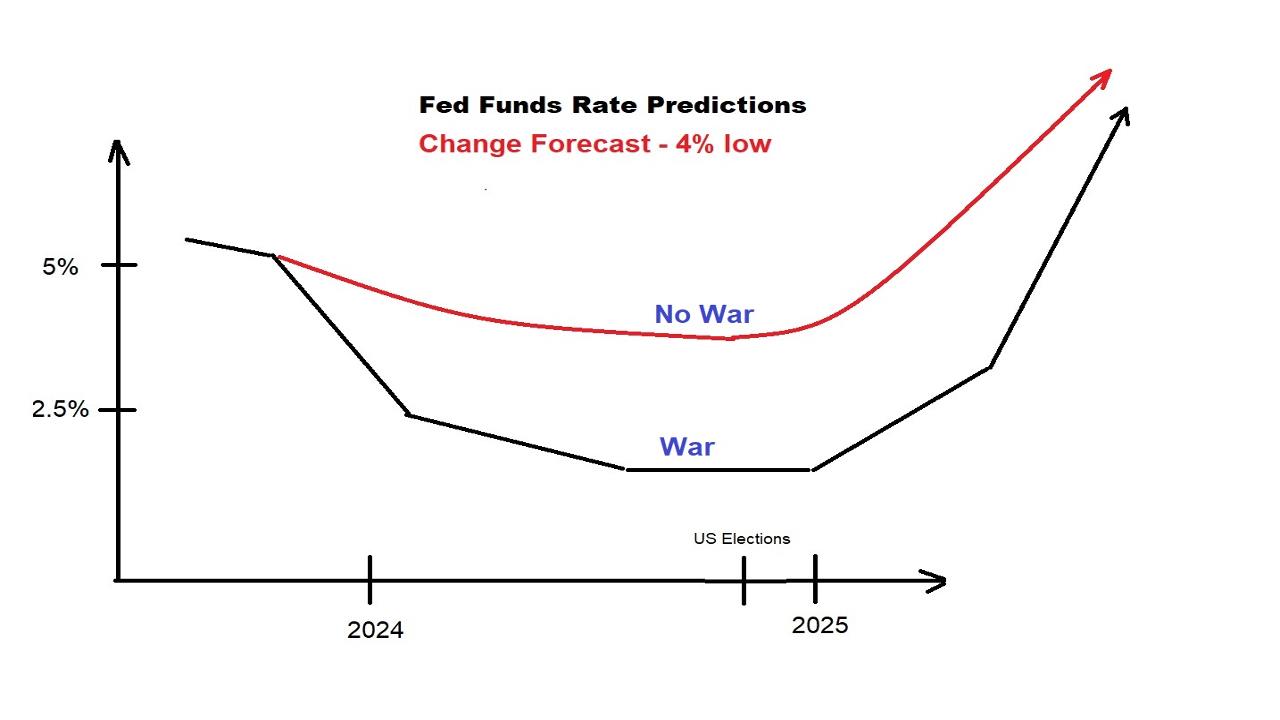

Chart:

References:

Comments