Video:

Take our online poll:

AI Analysis:

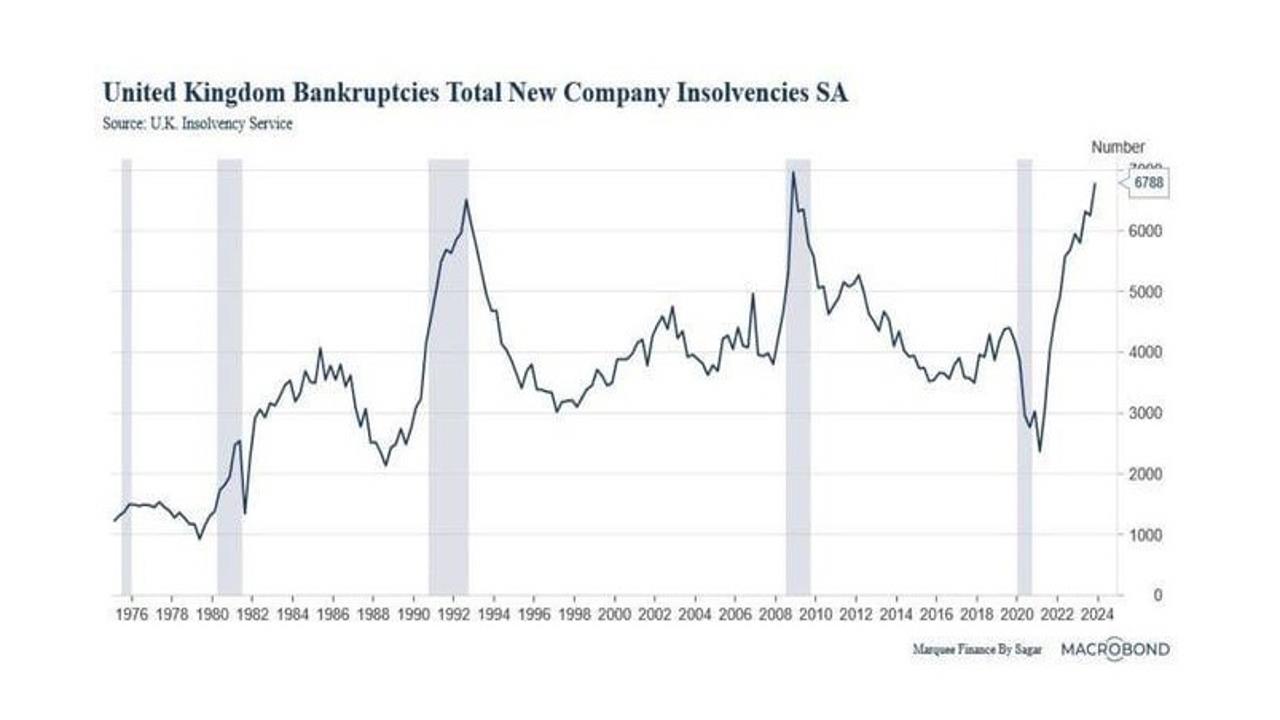

Bankruptcies can be one of the indicators used to assess the economic health of a country, but they should be considered alongside a broader set of economic indicators for a comprehensive understanding. Bankruptcies, or the number of businesses and individuals unable to meet their financial obligations, can provide insights into the economic environment, but their significance may vary based on specific circumstances. Here are some points to consider:

Economic Conditions:

During Downturns: An increase in bankruptcies may be indicative of economic challenges, such as a recession or financial crisis, where businesses face financial difficulties due to reduced consumer spending, increased debt, or other adverse conditions. During Expansion: In times of economic growth, bankruptcies may decrease as businesses benefit from increased consumer demand and favorable economic conditions.

Business Cycle Indicator:

Lagging Indicator: Bankruptcies often lag behind broader economic changes. They might reflect the impact of economic downturns that have already begun, making them a lagging indicator rather than a leading one.

Industry-Specific Considerations:

Varied Impact: Bankruptcies can affect specific industries differently. High bankruptcy rates in certain sectors may be a result of industry-specific challenges rather than a reflection of the overall economy.

Government Interventions:

Policy Impact: Government interventions, such as stimulus packages or financial aid programs, can influence bankruptcy rates. Temporary relief measures may mask underlying economic issues.

Global Factors:

International Impact: Economic conditions globally can affect domestic bankruptcies, especially in an interconnected global economy.

Consumer Behavior:

Consumer Confidence: Personal bankruptcies may be influenced by consumer confidence levels. During economic uncertainty, individuals may be more prone to financial distress.

Debt Levels:

Indication of Debt Stress: High levels of personal or corporate debt may contribute to increased bankruptcies. Monitoring debt levels alongside bankruptcy data provides a more comprehensive picture. Credit Conditions:

Tightening or Easing Credit: Changes in credit availability can impact bankruptcy rates. Tighter credit conditions may lead to more bankruptcies, while easier access to credit may have the opposite effect.

While bankruptcies can offer valuable insights into economic conditions, it's crucial to interpret them within the broader context of other economic indicators, such as GDP growth, employment rates, inflation, and consumer spending. A comprehensive analysis of multiple indicators provides a more accurate assessment of the overall economic health.

Chart:

References:

Comments