Video:

Take our online poll:

AI Analysis:

The "Minsky moment" refers to a sudden and severe collapse of asset values and market prices following a period of speculative excess and unsustainable debt accumulation. It is named after economist Hyman Minsky, who proposed the financial instability hypothesis. According to Minsky, stability in financial markets often breeds complacency, leading investors to take on increasing levels of risk, leverage, and debt. This behavior eventually reaches a tipping point where a seemingly small shock or trigger can set off a cascading series of defaults, asset sales, and panic selling, leading to a rapid and severe downturn.

Events that could potentially bring on a Minsky moment include:

Excessive Speculation: Prolonged periods of low interest rates or easy credit conditions can encourage investors to engage in speculative behavior, such as buying overvalued assets or taking on excessive leverage.

Asset Bubbles: Rapid appreciation in asset prices, such as housing, stocks, or cryptocurrencies, beyond their fundamental values can create a bubble that eventually bursts, triggering a Minsky moment.

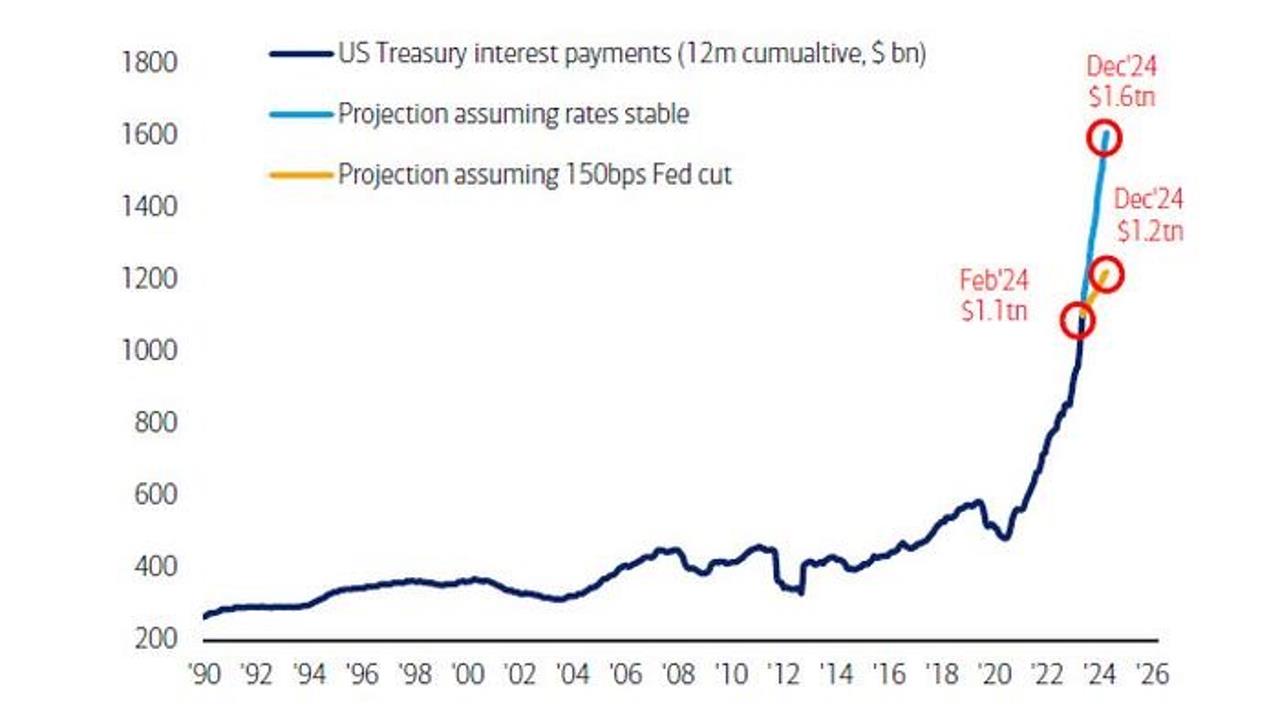

Leverage and Debt Build-Up: A buildup of debt, either at the household, corporate, or government level, beyond sustainable levels can make the financial system vulnerable to shocks.

Sudden Shifts in Market Sentiment: A sudden change in investor sentiment due to unexpected events, such as geopolitical tensions, regulatory changes, or economic downturns, can lead to panic selling and trigger a Minsky moment.

Liquidity Crisis: A shortage of liquidity in the financial system, where investors are unable to sell assets or obtain financing, can exacerbate selling pressure and amplify the effects of a Minsky moment.

Credit Crunch: A sudden tightening of credit conditions, where lenders become unwilling to extend credit or roll over existing loans, can lead to widespread defaults and trigger a Minsky moment.

Overall, a combination of these factors, coupled with a loss of confidence in the financial system, can lead to a Minsky moment, characterized by a rapid and severe collapse in asset values and market prices.

Chart:

References:

Comments