Video:

Take our online poll:

AI Analysis:

The Buffet Indicator, also known as the Buffett Indicator or the Total Market Cap to GDP Ratio, is a financial metric used to assess the overall valuation of the stock market relative to the size of the economy. It was popularized by renowned investor Warren Buffett, who famously referred to it as "the best single measure of where valuations stand at any given moment." The Buffet Indicator is calculated by dividing the total market capitalization of all publicly traded stocks by the Gross Domestic Product (GDP) of a country.

This indicator is considered valuable for several reasons. Firstly, it provides a broad and comprehensive view of market valuation, taking into account the combined value of all publicly traded companies relative to the economic output of the country. This holistic approach offers insights into whether the stock market is overvalued, undervalued, or fairly valued compared to historical norms.

Secondly, the Buffet Indicator serves as a useful tool for long-term investors seeking to gauge the attractiveness of equities as an asset class. By comparing the current ratio to historical averages, investors can identify potential opportunities or risks in the market. Additionally, the Buffet Indicator can offer a contrarian perspective, signaling periods of market exuberance or pessimism that may warrant adjustments to investment strategies.

Overall, while the Buffet Indicator is just one of many metrics used in financial analysis, its simplicity and broad applicability make it a valuable tool for investors navigating the complexities of the stock market.

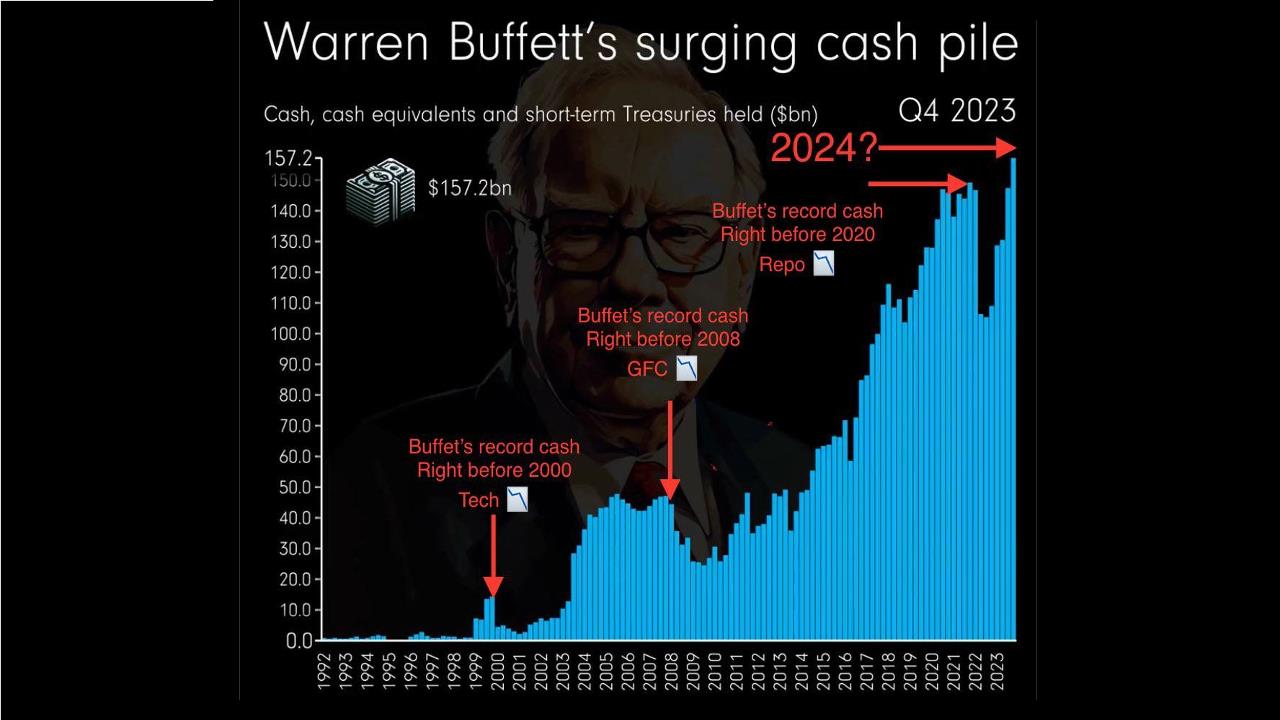

Chart:

References:

Comments