Video:

Take our online poll:

AI Analysis:

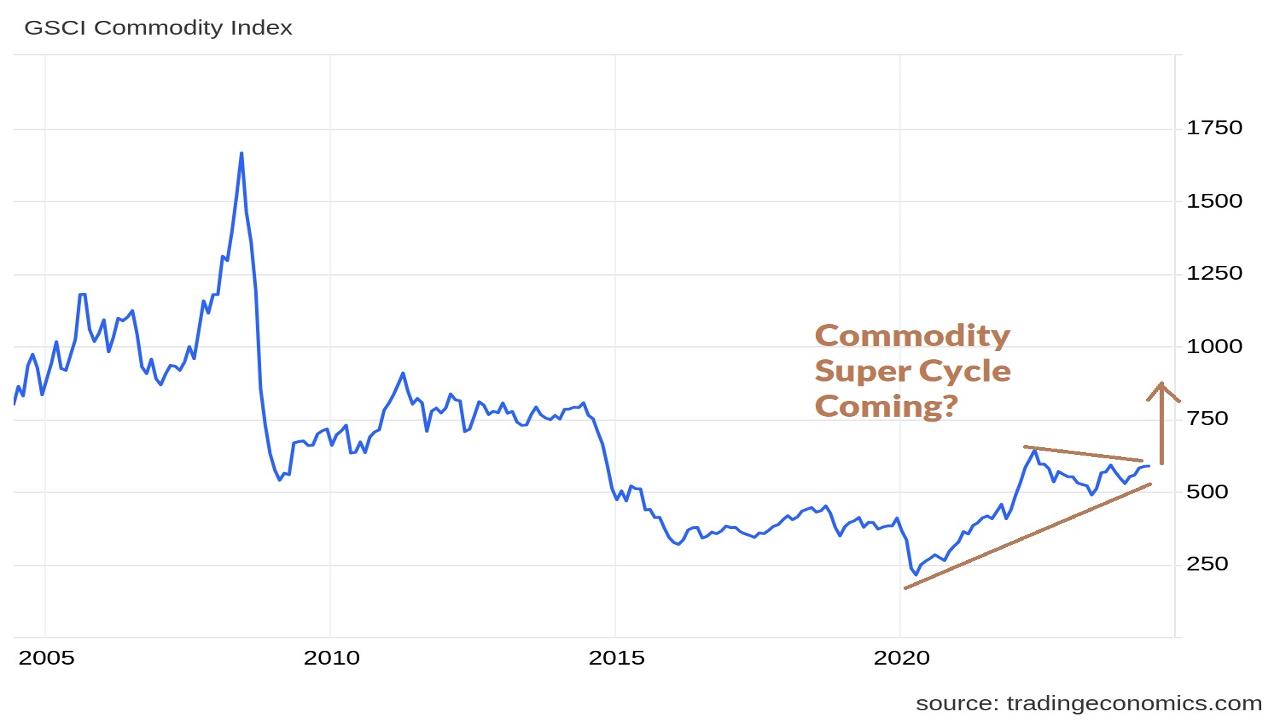

Commodity assets experience periodic bull runs or super cycles due to a variety of interrelated factors. Here are the major reasons:

Supply and Demand Dynamics:

Rising Demand: Economic growth, particularly in emerging markets, leads to increased demand for raw materials. Industrialization, urbanization, and infrastructural development drive up the need for commodities like oil, metals, and agricultural products.

Supply Constraints: Natural resource extraction and production often have long lead times and significant capital investment requirements. Any disruptions (e.g., geopolitical instability, natural disasters, labor strikes) can limit supply, driving prices up.

Global Economic Growth: Periods of synchronized global economic growth boost demand for a wide range of commodities. For instance, the rapid industrialization of China in the early 21st century significantly increased global demand for metals and energy, contributing to a commodity super cycle.

Inflation and Currency Movements: Commodities are often seen as a hedge against inflation. During periods of high inflation, investors may flock to commodities to preserve value, driving up prices. Additionally, the value of the U.S. dollar (in which most commodities are priced) affects commodity prices. A weaker dollar makes commodities cheaper for holders of other currencies, increasing demand.

Technological Innovations and Shifts: Advances in technology can spur new uses for existing commodities or increase the efficiency of their extraction and production. However, technological shifts can also lead to increased demand for certain commodities, such as lithium and cobalt for batteries in electric vehicles, potentially driving up prices.

Financial Market Dynamics:

Investment Flows: Commodities have become an asset class for investors, including hedge funds, mutual funds, and ETFs. Increased investment can drive up prices, creating a self-reinforcing cycle of higher prices attracting more investment.

Speculation: Speculators can drive prices higher by betting on future price increases. This can lead to significant price volatility and contribute to the formation of bubbles. Government Policies and Geopolitical Events:

Trade Policies: Tariffs, export restrictions, and subsidies can distort supply and demand dynamics, leading to price increases.

Geopolitical Tensions: Conflicts, sanctions, and political instability in key producing regions can disrupt supply chains and create uncertainty, driving up prices.

Structural Changes in the Economy: Long-term shifts, such as the transition to a green economy, can create sustained demand for certain commodities while decreasing demand for others. For example, the push for renewable energy has increased demand for metals like copper and rare earth elements.

Climate Change and Environmental Factors: Changing weather patterns can impact agricultural yields and the availability of water resources, influencing prices. Environmental regulations can also affect the supply side by imposing costs on production processes or limiting access to certain resources.

These factors can interact in complex ways to drive commodity prices into a bull run or even create a super cycle, where elevated prices persist for an extended period. Understanding these dynamics is crucial for investors and policymakers alike.

Chart:

References:

Comments