Video:

Take our online poll:

AI Analysis:

The Federal Reserve, often referred to as "the Fed," has several key mandates and responsibilities in the United States. Its primary objectives are aimed at promoting stable economic growth, price stability, and financial system stability. The mandates of the Federal Reserve include:

1) Price Stability: The Federal Reserve is tasked with maintaining stable prices and controlling inflation. It aims to keep the rate of inflation in check, which helps preserve the purchasing power of the currency. The Fed's long-run goal for inflation is typically around 2%.

2) Maximizing Employment: The Federal Reserve is also responsible for promoting maximum sustainable employment. While it cannot control the overall level of employment, it can influence employment conditions by conducting monetary policy. The Fed seeks to achieve a balance between low unemployment and stable prices.

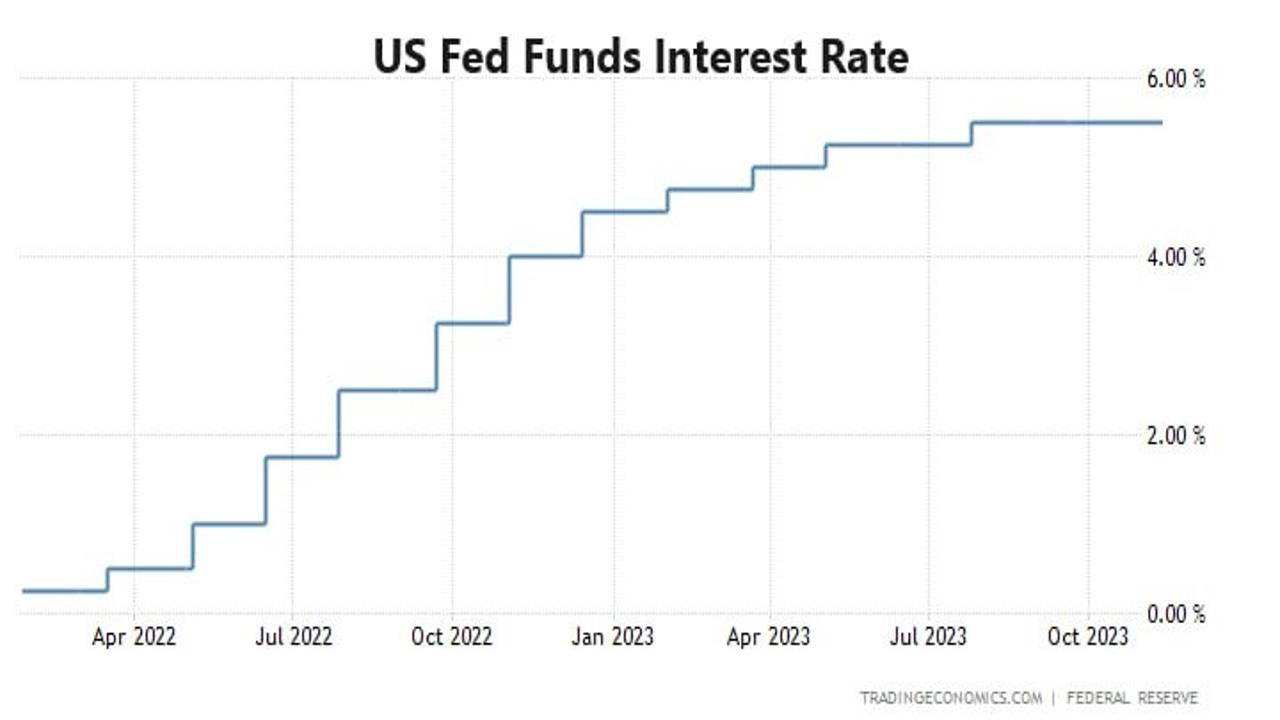

3) Monetary Policy: The Fed's primary tool for achieving its dual mandate of price stability and maximum employment is monetary policy. It sets short-term interest rates, such as the federal funds rate, and conducts open market operations to influence the money supply and credit conditions in the economy. The Fed uses these tools to control inflation and stimulate or cool economic activity as needed.

4) Financial Stability: In addition to its dual mandate, the Federal Reserve has a responsibility for ensuring the stability and soundness of the financial system. It supervises and regulates banks and financial institutions, monitors systemic risks, and implements policies to prevent financial crises.

5) Payment System Oversight: The Fed plays a critical role in overseeing and operating the payment system in the United States. It ensures the smooth and secure functioning of payment and settlement systems, such as the ACH (Automated Clearing House) and the Fedwire Funds Service.

6) Consumer Protection: The Federal Reserve is involved in various initiatives aimed at protecting consumers in the financial sector. It enforces laws related to fair lending, truth in lending, and other consumer protection regulations.

7) Research and Data Collection: The Fed conducts economic research, collects data, and publishes reports that provide valuable insights into the U.S. economy. This research is used to inform monetary policy decisions and economic analysis.

8) Financial Stability Oversight: The Dodd-Frank Wall Street Reform and Consumer Protection Act expanded the Fed's role in identifying and addressing systemic risks in the financial system. It also gave the Fed the authority to designate certain financial institutions as "systemically important" and subject to enhanced regulation.

9) Regulation and Supervision: The Federal Reserve supervises and regulates banks and financial institutions to ensure they operate in a safe and sound manner. It implements rules and regulations that govern various aspects of the financial industry.

10) Lender of Last Resort: In times of financial crises or liquidity problems, the Federal Reserve serves as a lender of last resort. It provides financial institutions with access to liquidity to prevent financial panics and maintain stability in the financial system.

These mandates and responsibilities guide the actions and policies of the Federal Reserve, and the Fed's decisions are made with the aim of achieving its dual mandate of stable prices and maximum employment while also ensuring financial stability and the smooth functioning of the U.S. payment system.

Chart:

References:

Comments