Video:

Take our online poll:

AI Analysis:

Taxation can play a role in supporting economic growth and prosperity when implemented effectively. However, relying solely on taxation as a means to achieve prosperity is not typically feasible. Prosperity is a multifaceted outcome influenced by various factors, including taxation policies, government spending, economic regulation, investment in infrastructure and education, innovation, and the overall business environment.

Taxation can be used to fund essential public services such as education, healthcare, infrastructure development, and social welfare programs, which are critical for fostering economic development and improving overall well-being. Additionally, well-designed tax policies can promote income equality, incentivize investment and entrepreneurship, and mitigate negative externalities such as pollution.

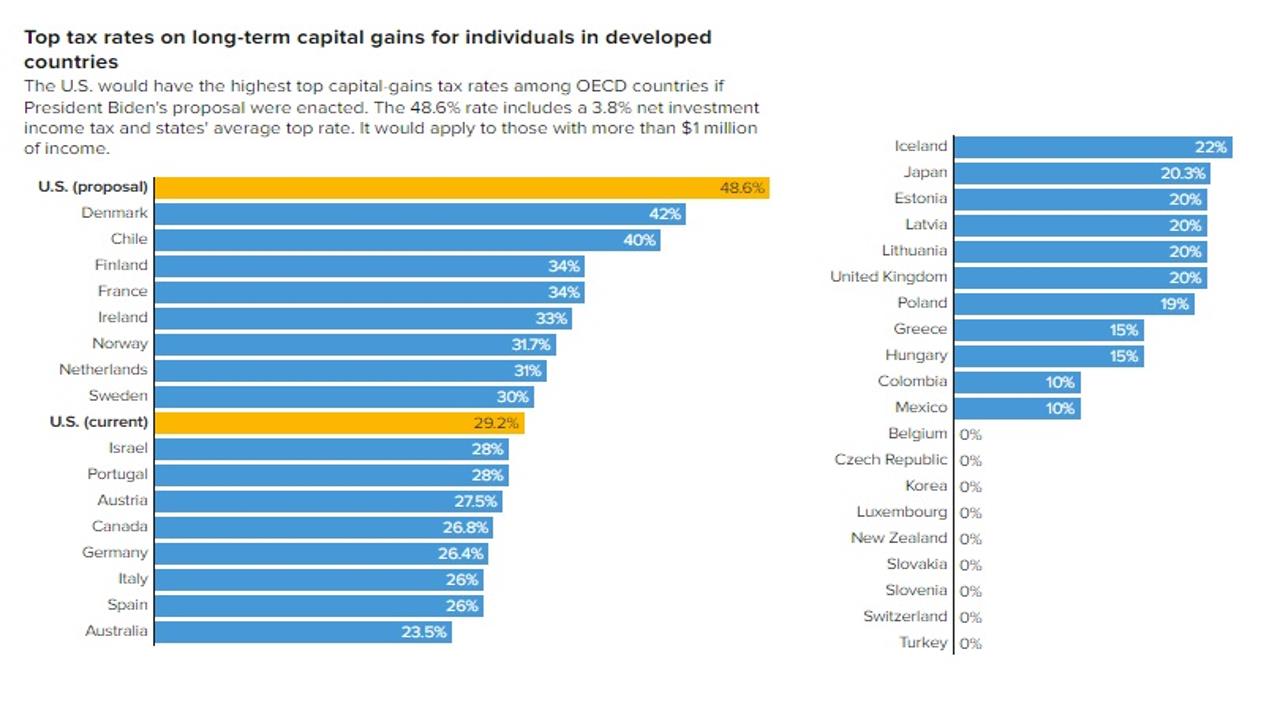

However, excessive or poorly designed taxation can have adverse effects on economic growth and prosperity. High tax rates may discourage work, investment, and innovation, leading to reduced productivity and economic stagnation. Moreover, complex and inefficient tax systems can create administrative burdens for businesses and individuals, hindering economic activity.

In summary, while taxation can contribute to prosperity when implemented judiciously and complemented by other supportive policies, it is not a standalone solution. A holistic approach that addresses various aspects of economic development and fosters a conducive business environment is essential for achieving sustained prosperity.

Chart:

References:

Comments