Video:

Take our online poll:

AI Analysis:

The Big Mac Index is a playful yet surprisingly effective method for evaluating currency values. It compares the price of a Big Mac burger across different countries to determine whether currencies are overvalued or undervalued relative to each other. Here's why it can be a useful indicator:

Standardized product: The Big Mac is a globally standardized product, meaning it should have a relatively consistent cost to produce and sell across countries. This makes it a good basis for comparison.

Purchasing Power Parity (PPP): The index is based on the economic theory of PPP, which suggests that in the long run, exchange rates should adjust to equalize the price of a basket of goods and services in different countries. The Big Mac Index uses the price of a single item (the Big Mac) as a simplified representation of this basket of goods.

Real-world application: Unlike some economic indicators that can be complex and abstract, the Big Mac Index is easy to understand and apply. It provides an intuitive way for people to grasp how currency values relate to each other.

Relative affordability: By comparing the price of a Big Mac in different countries, the index provides insight into the relative affordability of goods in those countries. A higher price for a Big Mac in one country compared to another suggests that the currency in the first country may be overvalued.

Informal measure: While not a precise economic tool, the Big Mac Index is widely followed and discussed, even by economists. It can offer insights into currency valuation trends and potential discrepancies in exchange rates.

However, it's important to note that the Big Mac Index has limitations. It doesn't consider factors such as non-tradable goods, transportation costs, taxes, and local preferences, which can all affect prices. Additionally, it provides a snapshot of currency valuation at a specific point in time and may not capture long-term trends accurately. Therefore, it's best used as a supplementary tool rather than the sole basis for making investment or currency valuation decisions.

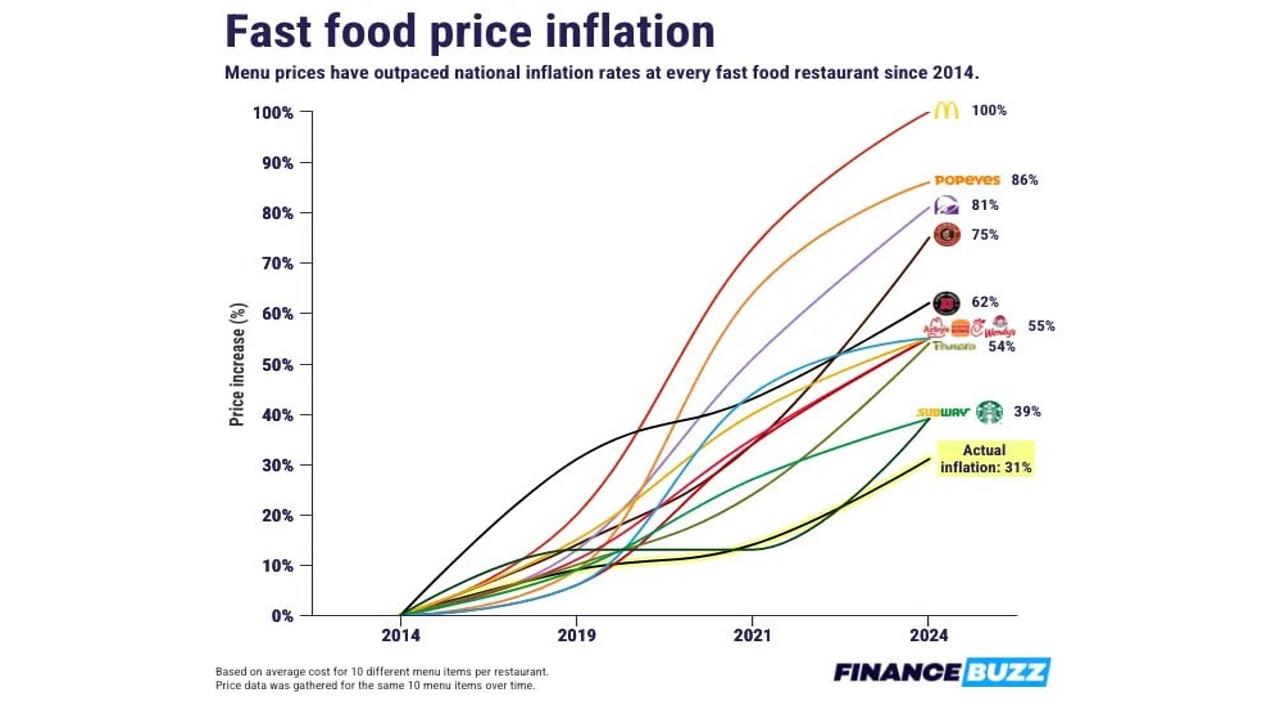

Chart:

References:

Comments