Video:

Take our online poll:

AI Analysis:

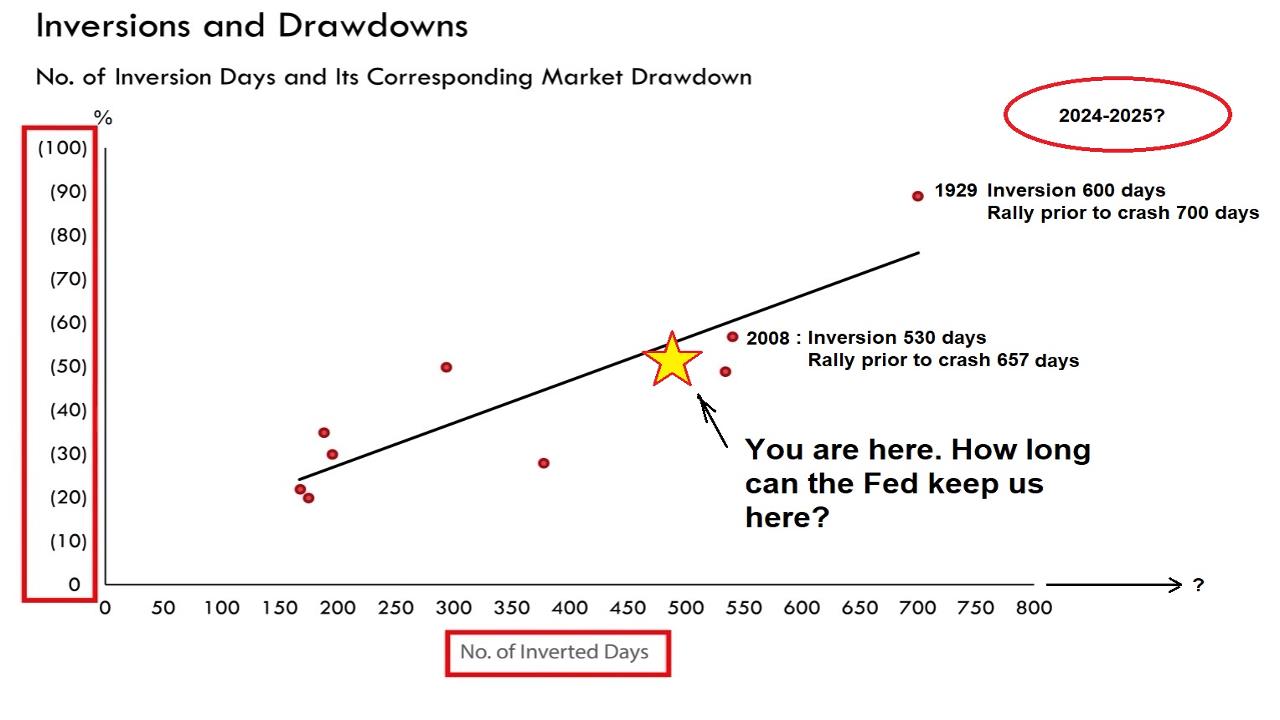

Yield curve inversions, particularly when short-term interest rates exceed long-term rates, often signal investor pessimism about future economic conditions. This inversion can lead to several economic mechanisms that eventually contribute to recessions:

Expectations of Economic Downturn: Inverted yield curves suggest that investors anticipate lower economic growth and possibly recessionary conditions in the future. This pessimism can lead to reduced investment and spending by businesses and consumers, which can dampen economic activity.

Credit Tightening: Banks and financial institutions rely on the yield curve to determine interest rates for lending. In an inverted yield curve scenario, banks may become more hesitant to lend, especially for long-term projects or investments. This tightening of credit can restrict businesses' access to capital, limiting their ability to expand or invest, thereby slowing economic growth.

Investor Behavior: Inverted yield curves can trigger negative investor sentiment and market volatility. Investors may react by selling stocks and other riskier assets and seeking safer investments, such as bonds. This flight to safety can further exacerbate market downturns and weaken consumer and business confidence.

Impact on Borrowing Costs: Inverted yield curves can also increase borrowing costs for businesses and consumers, especially for long-term loans and mortgages. Higher borrowing costs can deter investment and spending, leading to a slowdown in economic activity.

Overall, while yield curve inversions do not directly cause recessions, they serve as important warning signals of potential economic downturns. The combination of investor pessimism, credit tightening, negative market sentiment, and higher borrowing costs can collectively contribute to the onset of recessions.

Chart:

References:

Comments