Video:

Take our online poll:

AI Analysis:

When a country accepts loans or financial assistance from the International Monetary Fund (IMF), it often comes with a significant influence and a set of conditions that can impact various aspects of the country's economic and political landscape. Here are some of the key influences and consequences of accepting IMF loans:

1) Economic Policy Reforms: IMF loans typically come with conditions or "structural adjustment programs" that require the borrowing country to implement specific economic policy reforms. These reforms often include fiscal austerity measures, currency devaluation, trade liberalization, and privatization of state-owned enterprises.

2) Sovereign Autonomy: Countries that accept IMF loans may have to cede some degree of sovereignty in economic decision-making. The IMF often plays a role in shaping a country's economic policies, and this can be seen as a loss of control over domestic economic affairs.

3) Economic Stability: IMF loans can help stabilize a country's economy during a financial crisis or balance of payments problems. The funds provided can prevent currency devaluation, hyperinflation, and financial collapse, which can have positive economic impacts.

4) Foreign Investment: Accepting IMF loans may signal to foreign investors and creditors that the country is committed to economic stability and reform. This can lead to increased foreign direct investment and access to international capital markets.

5) Credibility and Creditworthiness: IMF assistance can enhance a country's credibility and creditworthiness in the eyes of international financial institutions and investors, making it easier to secure additional financing.

6) Social Consequences: Some of the policy reforms associated with IMF loans can have social consequences, such as reductions in public spending on education, healthcare, and social welfare programs. This can lead to social unrest and protests.

7) Political Impact: IMF programs can have political repercussions. Governments that implement IMF-mandated reforms may face backlash from their citizens, potentially leading to political instability or changes in leadership.

8) Economic Growth: While IMF loans are intended to stabilize economies, they may not always lead to sustained economic growth. The emphasis on austerity and certain reforms can hinder growth in the short term.

9) Debt Repayment: IMF loans are not free; they must be repaid with interest. The debt burden can become a significant financial obligation for the borrowing country.

10) Long-Term Structural Changes: IMF loans can lead to long-term structural changes in a country's economy. These changes can have both positive and negative effects, depending on how they are implemented and their impact on the country's economic and social fabric.

11) Transparency and Accountability: IMF programs often require countries to improve their economic data collection, transparency, and governance practices, which can be beneficial in the long run.

12) Crisis Prevention: In some cases, IMF loans can help prevent a financial crisis from escalating, which can have global spillover effects. This can be seen as a positive influence of IMF intervention.

The influence of IMF loans on a country's economic and political landscape is a complex and multifaceted issue. The specific outcomes depend on the terms and conditions of the loan agreement, the country's ability to implement the required reforms, and the broader socioeconomic and political context. While IMF assistance can be essential in times of economic crisis, it can also be a source of controversy and debate due to its influence on a nation's policies and sovereignty.

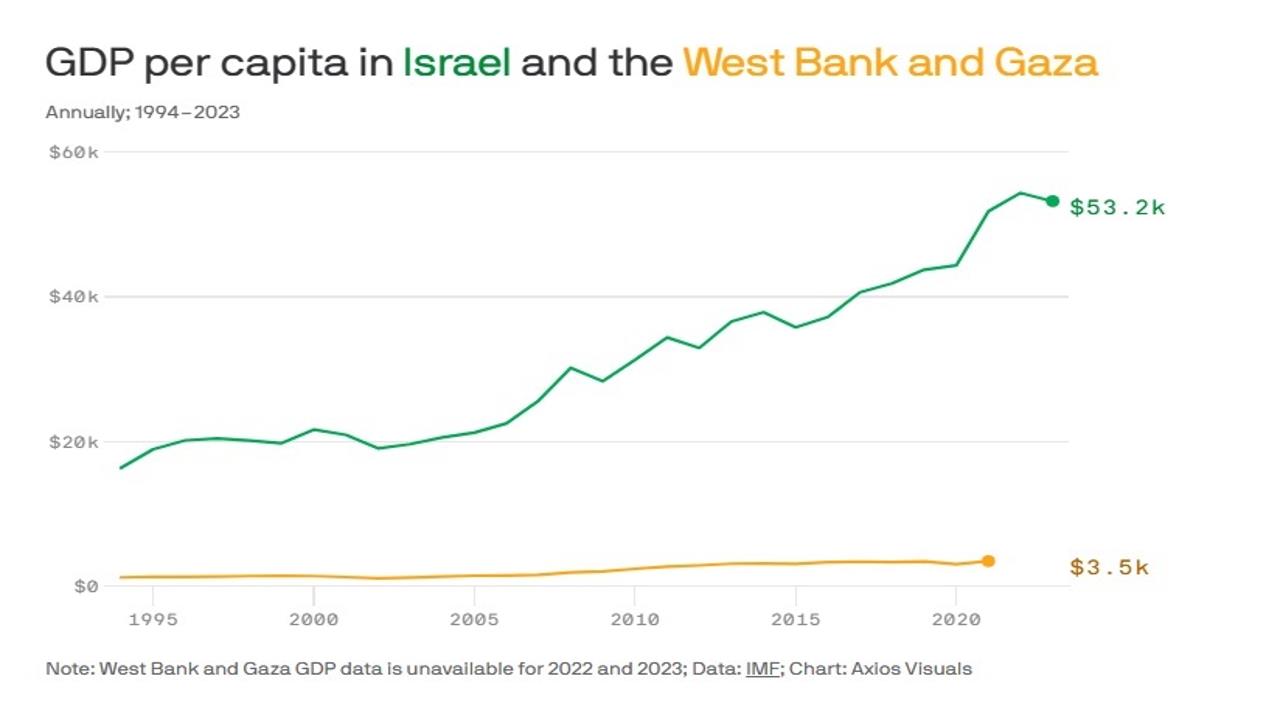

Chart:

References:

Comments