Video:

Take our online poll:

AI Analysis:

A wealth tax is a tax on an individual's net wealth, typically assessed on assets such as real estate, stocks, bonds, and other financial holdings. Advocates argue that wealth taxes can help address income inequality and generate revenue for government programs. However, there are both pros and cons associated with the implementation of a wealth tax:

Pros of a Wealth Tax:

1) Reduction of Wealth Inequality: Wealth taxes can help reduce wealth inequality by imposing higher taxes on the wealthiest individuals. Advocates argue that this can help redistribute wealth and promote economic fairness.

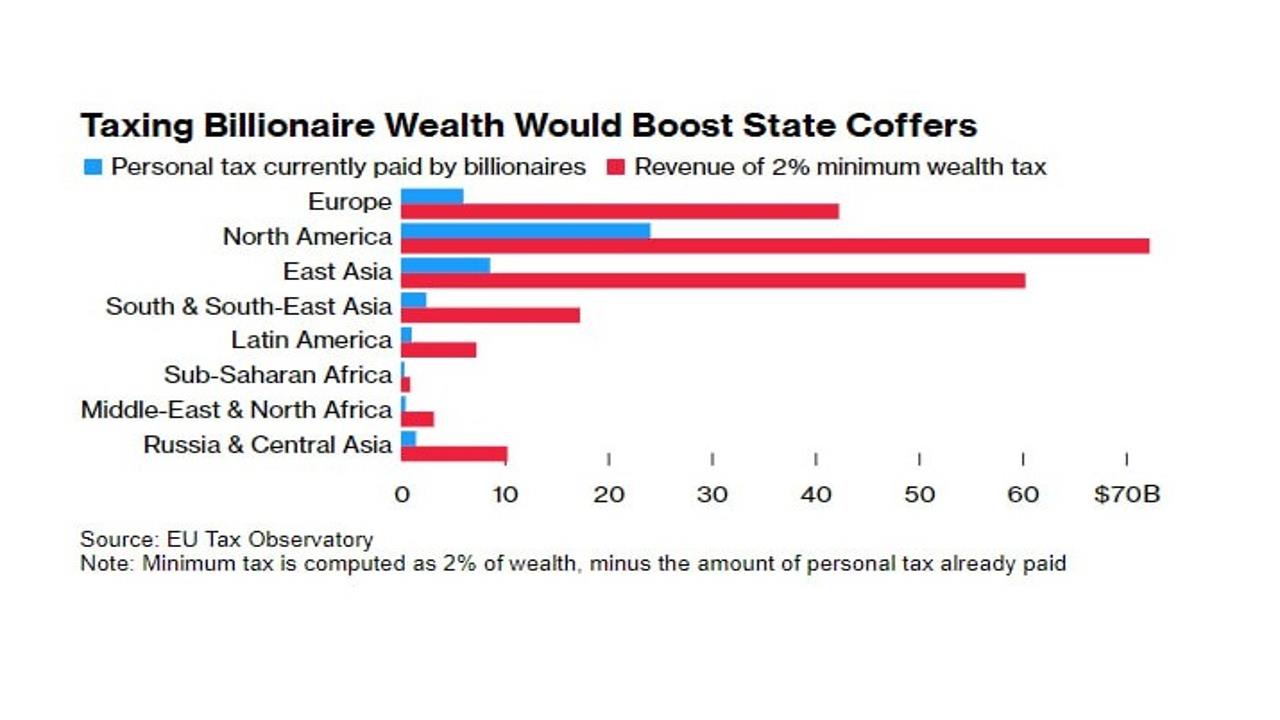

2) Additional Revenue: Wealth taxes can generate substantial revenue for government programs, which can be used to fund essential public services, infrastructure projects, and social safety nets.

3) Diversification of Tax Base: Introducing a wealth tax can diversify the sources of government revenue, reducing reliance on income or consumption taxes. This diversification can make the tax system more robust and stable.

4) Encouragement of Investment: To avoid wealth taxes, individuals may invest in more productive assets or investments, potentially spurring economic growth.

5) Estate Tax Redundancy: In some cases, a wealth tax can serve as a complement to an estate tax, helping prevent the concentration of wealth across generations.

Cons of a Wealth Tax:

1) Difficulty in Valuation: Valuing non-liquid assets such as art, real estate, and privately held businesses can be challenging and lead to disputes over the assessed value. This can be costly and administratively burdensome.

2) Capital Flight: High-net-worth individuals may seek to avoid wealth taxes by moving their assets or themselves to countries with lower or no wealth taxes. This can lead to capital flight, reduced domestic investment, and brain drain.

3) Economic Contraction: Critics argue that wealth taxes can stifle economic growth by reducing incentives for investment and entrepreneurship. This, in turn, can impact job creation and overall economic performance.

4) Reduced Savings and Investment: Wealth taxes can discourage savings and investment, as individuals may opt for consumption or tax-advantaged vehicles instead of holding wealth in taxable assets.

5) Administrative Costs: Implementing and enforcing wealth taxes can be expensive and complicated, especially when it involves evaluating the value of a wide range of assets. It may require significant administrative resources.

6) Avoidance and Evasion: High-net-worth individuals often have access to tax planning and evasion strategies, such as placing assets in tax havens or using legal loopholes, to reduce their tax liability.

7) Volatility: Revenue from wealth taxes can be volatile, as it depends on fluctuations in asset values, which can be influenced by economic cycles and market conditions.

8) Small Business Impact: Wealth taxes may affect small business owners and entrepreneurs, who may have significant net wealth tied up in their businesses. This could lead to financial stress for these entities.

9) Deterioration of Wealth: To pay wealth taxes, individuals may need to liquidate assets, which can lead to the deterioration of wealth and the loss of family businesses or assets over time.

10) Exemptions and Complexity: Exemptions and thresholds are often introduced to mitigate the impact on the middle class and small businesses, which can lead to increased complexity and administrative burdens.

The pros and cons of a wealth tax are subject to debate, and the effectiveness and desirability of such a tax depend on various factors, including how it is structured, its impact on economic behavior, and the broader economic and social context. Policymakers must carefully consider these factors when deciding whether to implement a wealth tax and how to design it in a way that achieves desired goals while minimizing negative consequences.

Chart:

References:

Comments